How Much Is Average Car Insurance Things To Know Before You Buy

Insurance providers supply a range of discounts. Look for discounts such as these: Offers to let you pay the entire yearly or six-month premium at onceAgreements to receive e-bills and documentationMemberships in specific organizations or groups that provide discount rates Do not be swayed by a long list of possible discount rates. how much does home insurance cost.

Compare both discount and routine rates from numerous insurance providers. Go over your insurance policy line by line and ask about removing anything you don't need. The price of automobile insurance coverage is most likely to continue to rise in the future. Nevertheless, there are lots of things you can do to decrease the sting. These 15 ideas need to get you driving in the right instructions. Whether you pay your premium regular monthly or each year, the expense of your vehicle insurance coverage deserves focusing on, as the price can increase for a range of reasons. The national typical cars and truck insurance coverage premium is $1,555 every year, but you may pay much more than that if you reside in a high-cost state, have poor credit or have occurrences on your driving record. First, it is very important to comprehend why your automobile insurance coverage may be so pricey. A number of factors can influence the expense of your policy , some of which are in your control, while others are beyond immediate influence. This post checks out why automobile insurance coverage is so expensive and what you can do to get Get more information the most affordable rate." If your car insurance premium is higher than.

you like, consider the various elements that impact your rate," Adams encouraged." Not only does the type of automobile you drive play a role, but so does your coverage amounts, deductibles, driving record, declares history, yearly mileage, credit, age, gender, marital status, and address. While you can drive carefully, you can't immediately remove accidents from your driving record.

How What Is The Difference Between Whole Life And Term Life Insurance can Save You Time, Stress, and Money.

Individual elements such as your age and gender will influence your rate no matter what. However you may be able to reduce your mileage, enhance your credit rating or alter your deductible total up to get a lower rate. Here are a few of them: The U.S. population has increased 6% given that 2010, and some city locations have grown even faster.() With more folks transferring to major citieswhere there's more traffic, more criminal offense and more uninsured motorists on the roadthey're most likely seeing a bump in just how https://diigo.com/0j2umr much they pay follow this link for vehicle insurance.

Drivers are more sidetracked by technology than ever in the past. Whether they're on their mobile phones or having fun with all the fancy functions in their newer cars and truck designs, they're driving like they have actually seen one a lot of Fast & Furious motion pictures.() And that's on top of all the other aspects that currently enter into computing a car insurance coverage quotethings like your age, the kind of cars and truck you drive and your driving record.

Today, the common American motorist pays an average annual premium of $1,470 for coverage. That's an all-time high!() Depending upon the state or city you call house, you may be getting a respectable deal for insurance coverageor you may seem like you're on the wrong end of highway robbery.

Some Known Details About How Much Is A Doctor Visit Without Insurance

Their rates jumped up by a massive 19% in 2015! Here are the five states that have the highest vehicle insurance rates in 2019:($16) Michigan ($ 2,693) Louisiana ($ 2,339) Rhode Island ($ 2,110) Florida ($ 2,059) Nevada ($ 1,915) If you reside in Detroit, MI, your vehicle insurance bill may be enough to keep you up late in the evening.

Yikes. However it's not all bad out there. There are 10 states where vehicle insurance rates really dropped in the past year. Drivers in Montana took pleasure in the largest dip in their rates (21%).(8) These five states have the most affordable annual car insurance coverage premiums in 2019: () Maine ($ 896) Virginia ($ 918) North Carolina ($ 947) Iowa ($ 988) Idaho ($ 1,018) Depending upon the state or city you call house, you may be getting a respectable offer for insurance coverage coverageor you might feel like you're on the incorrect end of highway robbery.

But are you truly predestined to pay sky-high rates permanently? Not so quick! If you're questioning whether you're getting the best offer on vehicle insurance in your location, deal with an who can help you find the least expensive readily available rates. The fact is that by numerous dollars! Here are some methods you can decrease your premiums much faster than a Ferrari going from 0 to 60 mph: If you get into a mishap or a tree branch easily chooses to fall on your windshield, your deductible is just how much you need to pay to repair your car prior to your insurance provider starts paying for the rest. how much is car insurance a month.

5 Easy Facts About What Is A Whole Life Insurance Policy Explained

You'll pay less for the repair work in the moment, but you're going to have much greater premiums as a result. If you have a complete emergency situation fund, raise your deductible! Having a greater deductible methods lower premiums. That's due to the fact that you're handling more threat (normally a couple of hundred dollars more per year), but you have deposit that permits you to cover it if you get in an accident.

Now it's time to look under the hood of your policy and discover out what type of protection you're actually paying for. Let's be extremely clear: There are specific you need to generally have in location. Those include Together, these three insurance coverage types offer you "complete coverage" from injuries and damage done to others to theft and damage done to your own cars and truck.

Here are some protections you might think about cutting if they're not required in your state: Extended Coverage Ensured Automobile Defense (GAP) Accident Defense (PIP) Consider it: When was the last time you shopped around for cars and truck insurance coverage? Was it when you purchased your automobile? Was that a year or two ago? Perhaps longer? In fact, one in three Americans with automobile insurance coverage has never looked around for better protection.() That's crazy! If you have a tidy driving record, you might conserve more than $400 each year on auto insurance simply by making the effort to compare quotes - how much insurance do i need.() That's why it's a great idea to try to find a much better deal a minimum of when each year.

Little Known Questions About Where Can I Go For Medical Care Without Insurance.

Insurers supply a range of discounts. Look for discount rates such as these: Deals to let you pay the entire annual or six-month premium at onceAgreements to receive e-bills and documentationMemberships in specific organizations or groups that provide discount rates Don't be swayed by a long list of possible discount rates. how to apply for health insurance.

Compare both discount rate and regular prices from several insurers. Discuss your insurance plan line by line and inquire about removing anything you don't require. The price of automobile insurance is most likely to continue to rise in the future. However, there are many things you can do to minimize the sting. These 15 suggestions need to get you driving in the right direction. Whether you pay your premium monthly or every year, the expense of your automobile insurance coverage is worth paying attention to, as the cost can increase for a range of reasons. The national average vehicle insurance coverage premium is $1,555 every year, however you might pay much follow this link more than that if you reside in a high-cost state, have bad credit or have events on your driving record. First, it is very important to comprehend why your vehicle insurance might be so pricey. Several elements can affect the cost of your policy , a few of which are in your control, while others are beyond instant influence. This short article checks out why automobile insurance is so pricey and what you can do to get the most affordable rate." If your car insurance premium is higher than.

you like, think about the different elements that impact your rate," Adams advised." Not only does the kind of cars and truck you drive play a function, but so does your protection amounts, deductibles, driving record, claims history, yearly mileage, credit, age, gender, marital status, and address. While you can drive thoroughly, you can't right away get rid of accidents from your driving record.

How Much Does Pet Insurance Cost Fundamentals Explained

Personal elements such as your age and gender will affect your rate no matter what. But you may be able to decrease your mileage, improve your credit rating or change your deductible quantity to get a lower rate. Here are some of them: The U.S. population has actually increased 6% since 2010, and some metro locations have grown even much faster.() With more folks relocating to major citieswhere there's more traffic, more crime and more uninsured motorists on the roadthey're likely seeing a bump in how much they spend for car insurance.

Motorists are more sidetracked by technology than ever before. Whether they're on their smartphones or having fun with all the fancy features in their newer vehicle models, they're driving like they've seen one a lot of Fast & Furious motion pictures.() And that's on top of all the other factors that currently go into determining an automobile insurance coverage quotethings like your age, the kind of car you drive and your driving record.

Today, the common American chauffeur pays an average yearly premium of $1,470 for protection. That's an all-time high!() Depending upon the state or city you call home, you might be getting a quite excellent offer for insurance coverage coverageor you might seem like you're on the incorrect end of highway break-in.

Get This Report on How Do I Know If I Have Gap Insurance

Their rates leapt up by a tremendous 19% last year! Here are the 5 states that have the highest car insurance rates in 2019:($16) Michigan ($ 2,693) Louisiana ($ 2,339) Rhode Island ($ 2,110) Florida ($ 2,059) Nevada ($ 1,915) If you live in Detroit, MI, your automobile insurance coverage costs might be enough to keep you up late at night.

Yikes. However it's not all bad out there. There are 10 states where car insurance coverage rates actually dropped in the previous year. Motorists in Montana took pleasure in the biggest dip in their rates (21%).(8) These 5 states have the most affordable annual vehicle insurance coverage premiums in 2019: () Maine ($ 896) Virginia ($ 918) North Carolina ($ 947) Iowa ($ 988) Idaho ($ 1,018) Depending upon the state or city you call home, you may be getting a respectable offer for insurance coverage coverageor you might feel like you're on the incorrect end of highway robbery.

But are you actually predestined to pay sky-high rates forever? Not so fast! If you're questioning whether or not you're getting the very best offer on automobile insurance in your area, deal with an who can help you discover the most affordable available rates. The reality is that by hundreds of dollars! Here are some ways you can decrease your premiums much faster than a Ferrari going from 0 to 60 miles per hour: If you enter into an accident or a tree branch conveniently chooses to fall on your windshield, your deductible is Get more information how much you need to pay to repair your automobile before your insurance provider starts spending for the rest. how to apply for health insurance.

A Biased View of What Is The Minimum Insurance Requirement In California?

You'll pay less for the repair work in the minute, however you're going to have much higher premiums as an outcome. If you have a full emergency situation fund, raise your deductible! Having a higher deductible methods lower premiums. That's due to the fact that you're taking on more risk (typically a few hundred dollars more each year), however you have deposit that enables you to cover it if you get in a mishap.

Now it's time to look under the hood of your policy and discover what kind of coverage you're actually paying for. Let's be really clear: There are certain you must usually have in place. Those consist of Together, these three insurance types provide you "full coverage" from injuries and damage done to others to theft and damage done to your own car.

Here are some coverages you might consider cutting if they're not needed in your state: Extended Protection Guaranteed Auto Defense (SPACE) Personal Injury Protection (PIP) Think about it: When was the last time you looked around for automobile insurance coverage? Was it when you purchased your cars and truck? Was that a year or 2 ago? Possibly longer? In truth, one in three Americans with cars and truck insurance coverage has actually never ever browsed for much better coverage.() That's insane! If you have a tidy https://diigo.com/0j2umr driving record, you could conserve more than $400 each year on automobile insurance simply by taking the time to compare quotes - what is gap insurance and what does it cover.() That's why it's an excellent idea to look for a better offer at least as soon as each year.

The Greatest Guide To What Is Comprehensive Insurance Vs Collision

First is the advantage duration and the removal period. You want to know for how long your policy will cover you for, and the length of time you need to wait after needing care, before your protection kicks in. These are functionally comparable to a deductible, and a policy worth. Decreasing your elimination or waiting period will raise the monthly cost of your policy, just as raising your benefit period will.

The other thing to analyze is whether your policy has inflation defense. As you will purchase a policy for something you require in 25+ years, the value could be considerably diminished - how to get rid of mortgage insurance. A lot of policies will include an inflation rider, and it will depend on you to determine what percent you desire, and if you want substance or basic inflation protection.

The majority of individuals opt for 3 percent, though 5 percent is offered. If you're seeking to purchase long term care insurance, you need to always consider a few things. Initially, do you perceive needing long term care, and know what it entails, and how it differs from medical insurance? Second, do you think you can pay to self guarantee, and are you https://penzu.com/p/ac981737 aware of how much your policy costs compared to cost savings towards a defined amount yourself? When you have actually evaluated those decisions (hopefully with a financial consultant) and made sure long term care insurance is best for you, the next step is to determine what level of premium expense and coverage you're comfortable with.

With the information above, you should be able to determine what policy is best for you, and feel comfy understanding your alternatives. You should be able to much better answer the question: "Is long term care insurance coverage worth it?" If you have any extra questions, reach out to our Mason Financing support personnel and we'll more than happy to help.

All about How To Become An Independent Insurance Agent

Long-term care insurance can protect personal properties and inheritance for the household, provide greater choice in the choice of long-term care settings (competent nursing facility care, helped living house, personal care house and house care) and usually offer financial security. Due to the fact that costs for long-term care policies can vary widely, even for similar policies, shopping and rate comparison is very important.

Greater day-to-day advantages and optional functions, such as inflation defense and non-forfeiture benefits, increase the premium. According to the Health Insurance Association of America, the annual premium for a low-option policy for a person at age 50 is about $850 annually; at 65, that exact same policy costs about $1,800; and at 79, about $5,500.

Counseling services might help you pick a policy most proper to your needs. Individuals acquire long-lasting care insurance coverage for several reasons. If you are choosing whether and when to purchase long-lasting care insurance coverage, you should consider the following questions: Will your income cover long-lasting care expenses, together with other ongoing costs? If you purchase such insurance coverage, can you spend for the deductible duration and coinsurance? Can you pay the premiums now? Can you pay if the premiums increase? Will you be able to pay the premiums if your spouse passes away? Will you have the ability to pay for updating benefits to fulfill inflation? Would you end up being eligible for Medicaid if you had big medical bills, or got in a nursing facility where typical yearly expenses run practically $30,000? According to the Centers for Medicare and Medicaid Solutions, before signing a long-term care insurance plan, you need to likewise ask if you have a period throughout which to cancel the policy and get a refund for the first premium.

Make certain the insurer can cancel your policy only for factor of non-payment of premiums. what is a health insurance premium. Make sure you have sensible inflation protection. Inspect the length of time that pre-existing conditions are left out. Examine for irreversible exclusions on particular conditions, such as Alzheimer's illness. Finally, if you decide to acquire long-term care insurance, do some checking into the credibility and monetary stability of the company using the insurance.

How Much Term Life Insurance Do I Need for Beginners

In 2007, a law was passed (Act 40) that developed the development of long-term care partnership policies in Pennsylvania. Long-term care partnership policies vary from standard long-lasting care insurance coverage because they are needed to use consumers certain alternatives and securities. Collaboration policies allow customers to secure individual possessions on a dollar-for-dollar basis.

Those secured properties are not thought about when determining eligibility for medical assistance or estate healing. Likewise, the law needs collaboration policies to supply extensive protection for all elements of long-lasting care, ranging from home and community-based care to skilled nursing center care (how much does insurance go up after an accident). A long-term care partnership policy has beneficial tax treatment and requires inflation security features that protect more youthful policyholders from boosts in expenditures brought on by inflation.

Customers can compare rates for sample policies on the state Department of Insurance Web website Business have actually simply started seeking approval from the state Department of Insurance coverage to provide long-lasting care collaboration policies in Pennsylvania. If you presently own a long-lasting care insurance coverage, or are considering purchasing one, ask your insurance provider if you will have the ability to exchange an existing policy for a collaboration policy when it appears.

Long-lasting care insurance is an insurance coverage that helps cover the costs of assisted living, nursing home, or at home care. It's bought independently from other types of life insurance. No, Medicare doesn't cover long-term care costs. Medicare just spends for short remain in proficient nursing centers, hospice care, or home healthcare if 3 conditions are met: You were confessed to the healthcare facility for 3 days or moreWithin thirty days of that hospital stay, you were confessed to a Medicare-certified proficient nursing facilityYou need skilled nursing, physical treatment, or other therapy services as prescribed by your doctorIf all those conditions are fulfilled, Medicare will pay a few of the expenses for the very first 100 days in a competent nursing facility.

The Basic Principles Of What Happens If I Don't Have Health Insurance

Long-lasting care policies can cover various kinds of long-term care. Not all policies cover every type of care. In-home careAssisted livingAdult day careRespite careHospice careNursing house/ experienced nursingAlzheimer's or dementia careHome caregiversCompanionsHousekeeperTherapistPrivate responsibility nurseHelp cover out-of-pocket medical expensesPremiums might be an earnings tax reduction for someBy DailyCaring Editorial StaffImage: Mesirow & Associates, PLLC Financial Help for Caregiving Expenditures 5 Keys to Assisting Aging Parents with Financial Resources 5 Crucial Legal Files for Caregivers.

Long term care insurance coverage will spend for your care in one of two methods: 1) Should you have a physical problems and need support with Activities of Daily Living (ADL's); or 2) Must you have a cognitive impairment such as Alzheimer's or dementia and need verbal cueing It pays for the expense of care you receive when you need assist with activities of day-to-day living (ADLs), such as consuming, bathing, dressing, and mobility normal activities that you may take for granted today, however due to your natural aging might become harder for you in the future.

Not known Facts About How To Find A Life Insurance Policy Exists

Insurance providers supply a variety of discounts. Inspect for discount rates such as these: Deals to let you pay the whole annual or six-month premium at onceAgreements to receive e-bills and documentationMemberships in specific companies or groups that provide discounts Do not be swayed by a long list of possible discount rates. what is https://diigo.com/0j2umr short term health insurance.

Compare both discount rate and regular prices from multiple insurance providers. Go over your insurance coverage policy line by line and inquire about eliminating anything you don't need. The rate of vehicle insurance is likely to continue to rise in the future. Nevertheless, there are lots of things you can do to minimize the sting. These 15 suggestions must get you driving in the best instructions. Whether you pay your premium monthly or every year, the expense of your car insurance coverage is worth taking notice of, as the cost can increase for a variety of reasons. The nationwide average vehicle insurance premium is $1,555 every year, but you might pay much more than that if you reside in a high-cost state, have poor credit or have events on your driving record. Initially, follow this link it's essential to understand why your vehicle insurance might be so expensive. Numerous factors can affect the expense of your policy , some of which remain in your control, while others are beyond instant influence. This short article explores why vehicle insurance coverage is so pricey and what you can do to get the most affordable rate." If your vehicle insurance coverage premium is greater than.

you like, think about the numerous elements that affect your rate," Adams encouraged." Not just does the type of vehicle you drive play a function, however so does your coverage amounts, deductibles, driving record, declares history, annual mileage, credit, age, gender, marital status, and address. While you can drive carefully, you can't immediately get rid of mishaps from your driving record.

What Does What Does Renters Insurance Not Cover Mean?

Individual elements such as your age and gender will affect your rate no matter what. But you may have the ability to lower your mileage, improve your credit history or change your deductible amount to get a lower rate. Here are some of them: The U.S. population has actually increased 6% considering that 2010, and some city areas have grown even faster.() With more folks relocating to significant citieswhere there's more traffic, more criminal offense and more uninsured drivers on the roadthey're most likely seeing a bump in just how much they spend for cars and truck insurance.

Chauffeurs are more distracted by innovation than ever before. Whether they're on their smart devices or playing with all the elegant functions in their newer vehicle designs, they're driving like they've seen one too numerous Quick & Furious movies.() And that's on top of all the other factors that already go into determining a car insurance quotethings like your age, the type of automobile you drive and your driving record.

Today, the normal American driver pays a typical yearly premium of $1,470 for protection. That's an all-time high!() Depending upon the state or city you call house, you might be getting a pretty good offer for insurance coverageor you may Get more information seem like you're on the wrong end of highway break-in.

Facts About How Much Does Motorcycle Insurance Cost Revealed

Their rates leapt up by a whopping 19% last year! Here are the five states that have the highest vehicle insurance coverage rates in 2019:($16) Michigan ($ 2,693) Louisiana ($ 2,339) Rhode Island ($ 2,110) Florida ($ 2,059) Nevada ($ 1,915) If you live in Detroit, MI, your cars and truck insurance bill may be enough to keep you up late in the evening.

Yikes. However it's not all bad out there. There are 10 states where automobile insurance rates in fact dropped in the previous year. Motorists in Montana enjoyed the biggest dip in their rates (21%).(8) These five states have the most affordable yearly auto insurance premiums in 2019: () Maine ($ 896) Virginia ($ 918) North Carolina ($ 947) Iowa ($ 988) Idaho ($ 1,018) Depending upon the state or city you call home, you may be getting a pretty excellent offer for insurance coverage coverageor you might seem like you're on the wrong end of highway burglary.

But are you really destined to pay sky-high rates forever? Not so fast! If you're wondering whether or not you're getting the very best offer on vehicle insurance coverage in your location, work with an who can help you find the most affordable available rates. The reality is that by hundreds of dollars! Here are some ways you can reduce your premiums quicker than a Ferrari going from 0 to 60 mph: If you enter an accident or a tree branch conveniently chooses to fall on your windshield, your deductible is just how much you have to pay to repair your cars and truck prior to your insurance coverage company starts spending for the rest. how much renters insurance do i need.

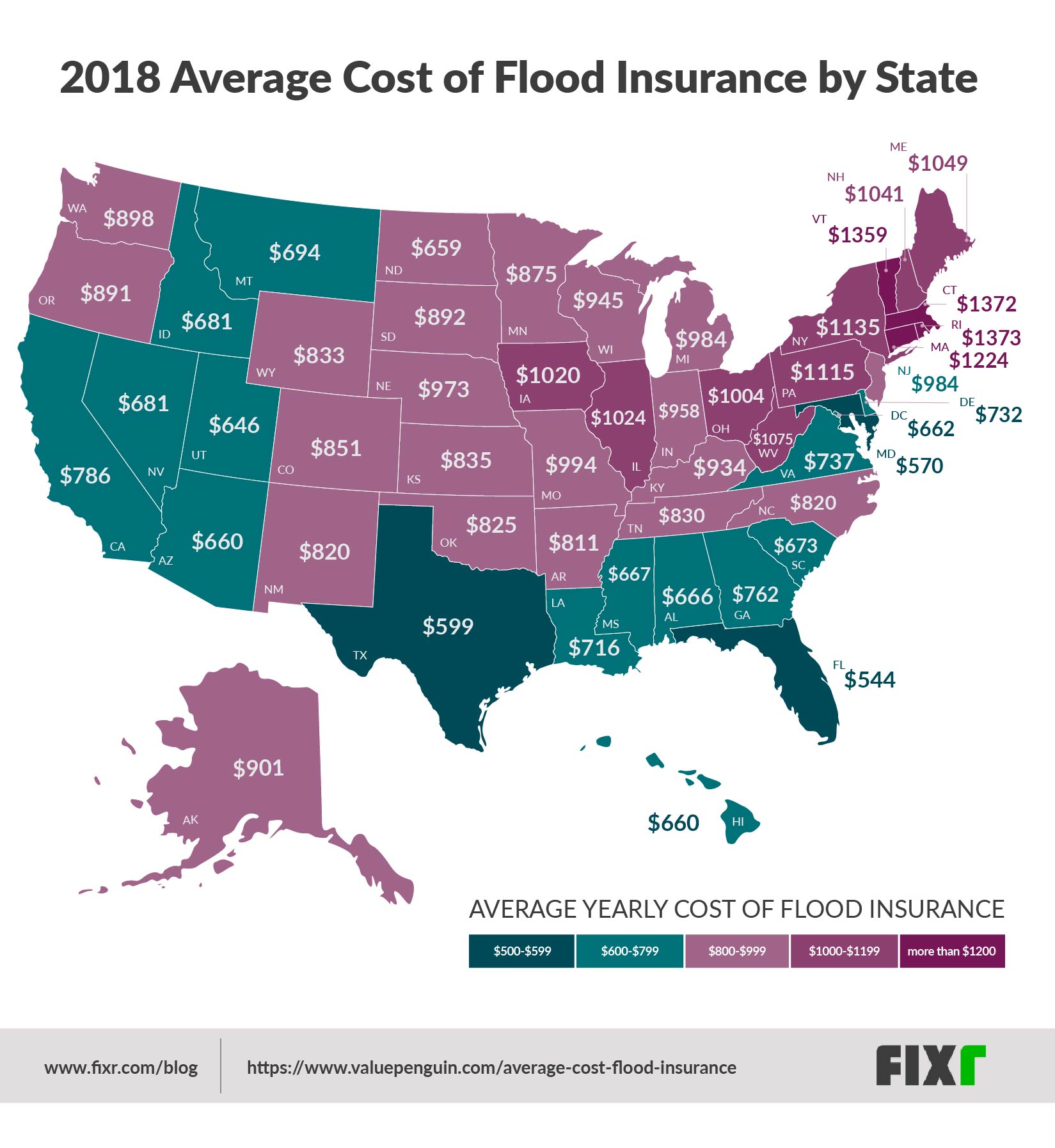

10 Simple Techniques For How Much Is Flood Insurance In Florida

You'll pay less for the repair work in the moment, but you're going to have much greater premiums as an outcome. If you have a full emergency situation fund, raise your deductible! Having a greater deductible methods lower premiums. That's because you're taking on more danger (generally a few hundred dollars more per year), but you have deposit that permits you to cover it if you get in a mishap.

Now it's time to look under the hood of your policy and discover what kind of coverage you're in fact paying for. Let's be really clear: There are certain you should often have in place. Those include Together, these 3 insurance coverage types give you "complete protection" from injuries and damage done to others to theft and damage done to your own car.

Here are some coverages you might consider cutting if they're not needed in your state: Extended Coverage Guaranteed Auto Protection (SPACE) Accident Security (PIP) Think Of it: When was the last time you looked around for car insurance coverage? Was it when you bought your car? Was that a year or more ago? Maybe longer? In truth, one in three Americans with car insurance coverage has actually never looked around for better protection.() That's insane! If you have a clean driving record, you might conserve more than $400 each year on vehicle insurance coverage simply by putting in the time to compare quotes - how to get health insurance after open enrollment.() That's why it's a great concept to search for a better offer at least as soon as each year.

What Health Insurance Pays For Gym Membership? for Beginners

These days, it's so easy to do. Just input your details into the insurance coverage companies' website and wait for the quote to come back. This is also a good time to look into discounts. Auto insurers desire your business, and they typically provide discount rates or rewards for utilizing their services.

Do not be reluctant to ask about discounts when you're looking around, too. Making monthly payments can look like less money upfront, but you can conserve a lot by paying annual premiums rather. It may be challenging to come up with such a large swelling sum initially, once you begin to understand the cost savings, you'll be delighted you went with this path.

You might have coverage on https://telegra.ph/some-known-facts-about-how-much-is-a-doctor-visit-without-insurance-11-28 your policy that you don't need, like GAP insurance coverage. Getting rid of these kinds of coverage will save you money. Stick to just the coverage that's right for you. The type of vehicle you drive absolutely impacts your insurance rate, so if you can switch to a cheaper automobile it could be advantageous.

Vehicle insurance coverage is costly, however it is an essential cost. Keep the reasons noted here in mind the next time you're thinking about methods to minimize your regular monthly automobile insurance expense. These pointers might assist you potentially save numerous dollars. Sources: This content is developed and preserved by a 3rd party, and imported onto this page to assist users offer their email addresses.

Wutthichai Luemuang/ EyeEmGetty Images Have you been asking yourself "why is my car insurance coverage so high?" without actually understanding what you're paying for and why you're being charged the rates that you are? If so, you're not alone. Many individuals don't totally understand what impacts their insurance rate or why premiums vary.

The 9-Second Trick For What Is The Difference Between Whole Life And Term Life Insurance

Cash Under 30 shares a few of them: Driving historyWhere you liveAgeType of vehicle you driveCredit Find more info scoreCoverageAll of these things and more will identify what an insurance coverage company will charge you for your insurance coverage. You'll find that there are a number of reasons why vehicle insurance can seem high. Your driving history plays a big part in how much car insurance coverage will cost you.

Drivers that have actually been involved in only minor collisions, such as minor car accident, are a much lower risk than those that have been in more major accidents in which an automobile may have been significantly harmed and even totaled. This means that even the kinds of accidents you've had will impact the rate you are going to pay.

The state you reside in is another determining factor for how much your cars and truck insurance will cost. Each state is allowed to set its own rates, and they do this based upon a variety of requirements. Check out this site Primarily, it belongs to population density, criminal activity rates, and traffic conditions. Transferring to a brand-new state isn't always an alternative, but if you truly need to reduce your automobile insurance coverage, you could think about transferring.

The rates in other states will differ, but if moving is an option for you, try shopping around to see which state can offer you the finest rate. Your age definitely comes into play when insurance coverage service providers are figuring out the rate they will charge you. This is partially due to the reality that younger motorists have not yet had the chance to prove that they are excellent motorists.

With this perspective, you can comprehend why an insurance coverage provider would charge higher rates for more youthful motorists. On the exact same note, male chauffeurs in between 20 to 29 years old are almost twice as likely to be in a fatal mishap than their female counterparts. how do health insurance deductibles work. This leads to greater premiums for males in this age range.

The Basic Principles Of How Much Does Insurance Go Up After An Accident

This includes both the make and design of the automobile. You'll pay various rates for driving a Ford, Honda, Toyota, or other makes. Certainly, the more expensive the car, the more you will pay to insure it, but for some, it's worth the price. High-end cars, such as an Alfa Romeo, will cost a pretty penny to insure, while a great safe minivan or little SUV will be more affordable.

Even drivers that have a tidy driving record will pay more for their car insurance coverage if their credit history does not meet the insurance coverage company's requirements for what is acceptable says Nerdwallet. Cleaning up your credit history could potentially conserve you cash on your regular monthly insurance costs. When it pertains to car insurance coverage, there are a number of different types of coverage readily available.

Complete coverage is required if you lease or have a bank loan on your car, and this type of protection will be more pricey. However, if you own your car outright, you can decide exactly what coverage you wish to have, as long as you bring a minimum of the needed minimum in your state.

Guaranteed Asset Defense, or GAP, insuranceExtended coveragePersonal Injury ProtectionWith GAP insurance, your loan will be settled in the event you're vehicle is totaled in an accident. If you don't have a loan, you do not require this kind of coverage. Extended coverage will help spend for damages that aren't usually covered under a common insurance coverage, such as vandalism or mechanical issues.

Accident protection will pay for medical expenses sustained from a cars and truck mishap. You may feel more secure having this kind of coverage, but it can conserve you money to do away with it. If you haven't been included in a mishap recently, you may feel comfortable not carrying this protection on your vehicle insurance plan.

Little Known Questions About What Is A Certificate Of Insurance.

Sources: This material is developed and maintained by a 3rd party, and imported onto this page to help users supply their e-mail addresses. You might have the ability to discover more information about this and similar material at piano. io.

Lots of factors both related to driving and otherwise result in pricey vehicle insurance premiums. Age, driving record, credit history, and insurance history each play into automobile insurance coverage rates. We describe listed below reasons car insurance could be expensive, along with some ways to conserve. Credit report is a main factor to car insurance coverage rates.

These motorists position significant threat to vehicle insurer. Typically, motorists with credit rankings in the "Extremely Poor" tier (300-579) pay $910 more for a six-month policy than do drivers with credit history in the "Remarkable" range (800-850). Each tier of credit history improvement comes with a typical cost savings of 17% or $193 per six-month term on automobile insurance coverage premiums.

Car insurance companies usually conflate age and driving experience. Motorists younger than 25 typically pay more for vehicle insurance than do older drivers, due to a viewed absence of driving experience. Chauffeurs in between the ages of 16 and 24 pay 139% more than drivers in between the ages of 25 and 75.

Motorists see big savings on their 19th, 20th, and 25th birthdays, particularly. Young drivers need to be specifically mindful of showing excellent driving habits. A bad driving record paired with an age of less than 25 will cause high premiums. A chauffeur's vehicle insurance premium could be expensive because of recent claims or driving infractions.

Some Known Incorrect Statements About What Is The Best Medicare Supplement Insurance Plan?

These days, it's so easy to do. Just input your information into the insurance companies' website and wait for the quote to come back. This is also a great time to look into discount rates. Auto insurance providers desire your organization, and they typically use discounts or incentives for using their services.

Do not hesitate to inquire about discount rates when you're looking around, too. Making month-to-month payments can seem like less money upfront, however you can conserve a lot by paying yearly premiums rather. It might be difficult to come up with such a big swelling sum in the beginning, once you start to recognize the savings, you'll be glad you went with this path.

You might have protection on your policy that you do not need, like GAP insurance coverage. Eliminating these types of protection will conserve you money. Stick to simply the coverage that's right for you. The type of car you drive absolutely impacts your insurance coverage rate, so if you can change to a less costly vehicle it might be beneficial.

Cars and truck insurance is costly, however it is a necessary expenditure. Keep the factors listed here in mind the next time you're thinking about ways to lower your regular monthly cars and truck insurance bill. These pointers could assist you potentially save hundreds of dollars. Sources: This material is developed and maintained by a 3rd party, and imported onto this page to help users provide their e-mail addresses.

Wutthichai Luemuang/ EyeEmGetty Images Have you been asking yourself "why is my automobile insurance coverage so high?" without actually understanding what you're paying for and why you're being charged the rates that you are? If so, you're not alone. Lots of people do not totally understand what impacts their insurance rate or why premiums fluctuate.

Get This Report about How Much Does Motorcycle Insurance Cost

Cash Under 30 shares a few of them: Driving historyWhere you liveAgeType of lorry you driveCredit scoreCoverageAll of these things and more will identify what an insurance coverage provider will charge you for your insurance plan. You'll discover that there are a variety of factors why vehicle insurance coverage can seem high. Your driving history plays a huge part in just how much car insurance will cost you.

Motorists that have been associated with only small crashes, such as fender benders, are a much lower threat than those that have actually been in more severe accidents in which a car might have been seriously damaged or even amounted to. This indicates that even the types of accidents you have actually had will affect the rate you are going to pay.

The state you live in is another identifying element for how much your cars and truck insurance will cost. Each state is allowed to set its own rates, and they do this based on a number of requirements. Primarily, it relates to population density, criminal offense rates, and traffic conditions. Moving to a new state isn't constantly a choice, but if you really require to reduce your car insurance, you could consider moving.

The rates in other states will differ, but if moving is an option for you, try going shopping around to see which state can offer you the very best rate. Your age definitely enters into play when insurance companies are finding out the rate they will charge you. This is partly due to the truth that more youthful motorists have not yet had the opportunity to prove that they are excellent drivers.

With this point of view, you can understand why an insurance coverage supplier would charge higher rates for younger motorists. On the exact same note, male drivers in between 20 to 29 years of ages are practically twice as most likely to be in a fatal mishap than their female counterparts. how much does a tooth implant cost with insurance. This leads to higher premiums for males in this age range.

Examine This Report on Which One Of These Is Covered By A Specific Type Of Insurance Policy?

This includes both the make and design of the car. You'll pay different rates for driving a Ford, Honda, Toyota, or other makes. Obviously, the more pricey the car, the more you will pay to insure it, but for some, it's worth the cost. High-end sports vehicles, such as an Alfa Romeo, will cost a quite penny to guarantee, while a nice safe minivan or small SUV will be more affordable.

Even chauffeurs that have a tidy driving record will pay more for their vehicle insurance if their credit history does not fulfill the insurance coverage company's standards for what is appropriate says Nerdwallet. Tidying up your credit report might possibly conserve you money on your monthly insurance bill. When it comes to car insurance coverage, there are a variety of different types of coverage offered.

Complete coverage is needed if you lease or Check out this Find more info site have a bank loan on your car, and this type of protection will be more expensive. However, if you own your vehicle outright, you can decide precisely what protection you want to have, as long as you bring a minimum of the required minimum in your state.

Guaranteed Property Defense, or SPACE, insuranceExtended coveragePersonal Injury ProtectionWith SPACE insurance, your loan will be settled in the event you're automobile is totaled in an accident. If you do not have a loan, you don't need this type of protection. Prolonged protection will assist spend for damages that aren't usually covered under a typical insurance coverage, such as vandalism or mechanical issues.

Personal injury defense will spend for medical bills sustained from a car mishap. You may feel more secure having this kind of protection, but it can save you money to do away with it. If you haven't been associated with a mishap just recently, you may feel comfy not carrying this protection on your automobile insurance coverage.

The Facts About How Much Does Life Insurance Cost Revealed

Sources: This content is produced and kept by a 3rd party, and imported onto this page to help users supply their e-mail addresses. You might have the ability to find more details about this and comparable content at piano. io.

Lots of factors both related to driving and otherwise lead to costly car insurance coverage premiums. Age, driving record, credit report, and insurance history each play into cars and truck insurance coverage rates. We describe below factors car insurance coverage could be costly, along with some ways to save. Credit report is a main contributor to automobile insurance coverage rates.

These drivers pose considerable threat to cars and truck insurer. On average, drivers with credit rankings in the "Really Poor" tier (300-579) pay $910 more for a six-month policy https://telegra.ph/some-known-facts-about-how-much-is-a-doctor-visit-without-insurance-11-28 than do chauffeurs with credit history in the "Exceptional" variety (800-850). Each tier of credit report enhancement features a typical cost savings of 17% or $193 per six-month term on auto insurance premiums.

Cars and truck insurer typically conflate age and driving experience. Chauffeurs younger than 25 typically pay more for cars and truck insurance than do older motorists, due to a perceived absence of driving experience. Motorists between the ages of 16 and 24 pay 139% more than motorists in between the ages of 25 and 75.

Drivers see huge savings on their 19th, 20th, and 25th birthdays, particularly. Young motorists need to be specifically mindful of displaying great driving habits. A bad driving record paired with an age of less than 25 will cause high premiums. A chauffeur's car insurance premium might be pricey because of current claims or driving offenses.

5 Easy Facts About How Much Does Health Insurance Cost Per Month Shown

Nowadays, it's so simple to do. Just input your information into the insurance coverage suppliers' site and wait for the quote to come back. This is also a great time to look into discount rates. Automobile insurance companies want your business, and they typically offer discount rates or incentives for using their services.

Do not hesitate to ask about discount rates when you're looking around, too. Making monthly payments can look like less cash upfront, however you can save a lot by paying yearly premiums instead. It may be hard to come up with such a big lump sum in the beginning, once you begin to recognize the cost savings, you'll be glad you selected this path.

You might have coverage on your policy that you do not need, like GAP insurance. Eliminating these types of protection will conserve you cash. Stick with simply the coverage that's right for you. The type of car you drive absolutely impacts your insurance coverage rate, so if you can switch to a less costly car it might be beneficial.

Vehicle insurance coverage is pricey, however it is an essential expense. https://telegra.ph/some-known-facts-about-how-much-is-a-doctor-visit-without-insurance-11-28 Keep the factors noted here in mind the next time you're thinking about methods to reduce your regular monthly vehicle insurance expense. These pointers might assist you potentially save numerous dollars. Sources: This material is produced and kept by a 3rd party, and imported onto this page to assist users offer their email addresses.

Wutthichai Luemuang/ EyeEmGetty Images Have you been asking yourself "why is my cars and truck insurance coverage so high?" without really understanding what you're paying for and why you're being charged the rates that you are? If so, you're not alone. Lots of people do not totally understand what affects their insurance coverage rate or why premiums vary.

The Ultimate Guide To How Much Does Long Term Care Insurance Cost

Money Under 30 shares a few of them: Driving historyWhere you liveAgeType of vehicle you driveCredit scoreCoverageAll of these things and more will identify what an insurance coverage company will charge you for your insurance coverage. You'll discover that there are a number of factors why vehicle insurance coverage can appear high. Your driving history plays a big part in just how much car insurance will cost you.

Chauffeurs that have actually been associated with only minor crashes, such as minor car accident, are a much lower danger than those that have actually been in more severe accidents in which an automobile might have been badly damaged or even totaled. This implies that even the types of accidents you've had will affect the rate you are going to pay.

The state you live in is another figuring out aspect for just how much your cars and truck insurance coverage will cost. Each state is permitted to set its own rates, and they do this based on a variety of criteria. Generally, it relates to population density, criminal activity rates, and traffic conditions. Transferring to a new state Find more info isn't constantly an alternative, but if you really need to decrease your car insurance coverage, you could think about transferring.

The rates in other states will differ, but if moving is a choice for you, attempt shopping around to see which state can provide you the very best rate. Your age definitely comes into play when insurance coverage companies are finding out the rate they will charge you. This is partly due to the reality that younger motorists have not yet had the chance to show that they are great motorists.

With this viewpoint, you can understand why an insurance supplier would charge greater rates for younger chauffeurs. On the very same note, male motorists between 20 to 29 years old are nearly twice as likely to be in a fatal accident than their female equivalents. how much is car insurance a month. This leads to greater premiums for males in this age range.

How Much Does Dental Insurance Cost Can Be Fun For Everyone

This consists of both the make and model of the automobile. You'll pay various rates for driving a Ford, Honda, Toyota, or other makes. Undoubtedly, the more expensive the vehicle, the more you will pay to insure it, but for some, it's worth the rate. High-end sports cars and trucks, such as an Alfa Romeo, will cost a pretty cent to insure, while a great safe minivan or little SUV will be much cheaper.

Even motorists that have a clean driving record will pay more for their car insurance if their credit history does not meet the insurance coverage supplier's standards for what is appropriate states Nerdwallet. Cleaning up your credit history might possibly conserve you cash on your regular monthly insurance coverage expense. When it pertains to cars and truck insurance coverage, there are a variety of different types of coverage available.

Full protection is required if you rent or have a bank loan on your car, and this kind of protection will be more expensive. Nevertheless, if you own your lorry outright, you can decide precisely what protection you desire to have, as long as you bring a minimum of the required minimum in your state.

Guaranteed Possession Defense, or GAP, insuranceExtended coveragePersonal Injury ProtectionWith GAP insurance, your loan will be paid off in case you're vehicle is totaled in an accident. If you don't have a loan, you don't require this kind of coverage. Extended coverage will assist pay for damages that aren't generally covered under a common insurance coverage policy, such as vandalism or mechanical concerns.

Personal injury defense will pay for medical expenses incurred from a car mishap. You might feel more secure having Check out this site this type of protection, however it can save you money to do away with it. If you have not been included in an accident recently, you might feel comfortable not carrying this protection on your vehicle insurance policy.

What Does How Much Renters Insurance Do I Need Mean?

Sources: This content is created and kept by a third party, and imported onto this page to assist users offer their e-mail addresses. You might have the ability to find more details about this and similar material at piano. io.

Numerous aspects both related to driving and otherwise cause pricey vehicle insurance coverage premiums. Age, driving record, credit rating, and insurance coverage history each play into car insurance coverage rates. We lay out below reasons automobile insurance could be costly, together with some ways to conserve. Credit history is a primary factor to car insurance coverage rates.

These drivers posture considerable risk to car insurance provider. Typically, chauffeurs with credit scores in the "Really Poor" tier (300-579) pay $910 more for a six-month policy than do chauffeurs with credit history in the "Exceptional" variety (800-850). Each tier of credit history improvement includes an average savings of 17% or $193 per six-month term on vehicle insurance premiums.

Vehicle insurer usually conflate age and driving experience. Chauffeurs more youthful than 25 typically pay more for cars and truck insurance coverage than do older drivers, due to a perceived absence of driving experience. Chauffeurs between the ages of 16 and 24 pay 139% more than chauffeurs in between the ages of 25 and 75.

Drivers see big cost savings on their 19th, 20th, and 25th birthdays, particularly. Young drivers need to be especially conscious of showing excellent driving habits. A bad driving record paired with an age of less than 25 will lead to high premiums. A motorist's automobile insurance premium could be pricey due to the fact that of current claims or driving infractions.

9 Easy Facts About How Much Is A Unit Of Colonial Penn Life Insurance? Shown

Many individuals buy term protection when they remain in their 20s because it seems more inexpensive when compared to a money value life insurance policy with the exact same death advantage amount. By the time they're in their 40s, the protection seems a bit costly, as the rate goes up. In their 50s, the cost has actually usually overtaken the expense of permanent coverage.

Meanwhile, the individual who may have paid more for that permanent policy in his or her 20s may still be paying the same premium. That's why the term policy's conversion opportunity is so important. This valuable function is generally offered in the first couple of years of the policy, and enables you to transform to irreversible insurance coverage without sending proof of insurability.

The worth of irreversible life insurance. Cash worth life insurance coverage can be a strong long-term service for many individuals. The factors: Cash value life insurance provides life-long insurance coverage protection, supplied premiums are paid. With few exceptions, once you have been authorized for the protection, your policy can not be canceled by the provider.

In spite of higher initial premiums, cash worth life insurance coverage can really be MORE ECONOMICAL than term in the long run. Many permanent policies are eligible for dividends, which are not ensured, if and when they are stated by the insurance business. Numerous companies provide the option to apply present and collected dividend values towards payment of all or part of the premiums.

So while premiums must be paid under both the permanent and term insurance coverage strategies, long-term out-of-pocket expense of long-term life insurance coverage may be lower compared to the overall cost for a term policy. It can get rid of the issue of future insurability. Cash worth life insurance coverage does not expire after a certain duration of time.

It develops CASH VALUE. This amountpart of which is ensured under lots of policiescan be used in the future for any function you wish. If you like, you can borrow money value for a down payment on a home, to help spend for your kids's education, or to provide earnings https://timesharecancellations.com/test/ for your retirement.

The Buzz on What Does Renters Insurance Not Cover

As you reach a number of life's major milestones, you may find yourself paying more attention to the concern of life insurance coverage. While it may not constantly be a simple subject to talk about, its benefits might assist your household pay off expenditures and help provide assurance when you're gone.

Here, we have actually covered the basics of term life insurance coverage to assist you decide if this is the best policy for you. Among the different kinds of life insurance, term life insurance is typically deemed one of the most economical choices. Term life insurance coverage pays a benefit if you pass away throughout the insurance coverage period.

The premium must be paid in a timely manner for the policy to remain active. The length of term life insurance coverage depends on what policy you buy. For circumstances, if you purchased a policy that lasted for five years, you would be covered the entire time unless you were to stop paying your premiums.

Insurance provider may also set an optimum age limit for for how long the policy can last. Term life insurance coverage covers death from many causes, but there are a few exceptions when a term life insurance policy might not cover you. These are understood as exemptions and will be detailed in your policy.

Term life insurance also may not cover somebody who lied or left info off their application that was connected to their eventual cause of death. For numerous people, the primary benefit of a term life insurance policy is its rate. These policies tend to be less costly than irreversible life insurance coverage policies - why is my car insurance so high.

During this time, your premiums will stay the very same. Term life insurance coverage is likewise reasonably basic to understand. You pay a premium, and after that your recipients receive the survivor benefit if you pass away as long as premiums have actually been paid. Other policies may have more functions and benefits that could take a little more research study to understand.

The 5-Minute Rule for How Much Should I Be Paying For Car Insurance

There are two fundamental categories of term life insurance: guaranteed level and renewable/convertible. These categories are not mutually exclusive. An ensured level term policy is a popular choice since the premium stays the exact same for the whole policy length. Without any cost boosts throughout this term, it offers an affordable way to acquire life insurance coverage.

A renewable/convertible life insurance coverage policy can be either short-term or extended. As its name recommends, an eco-friendly policy can be periodically restored without any additional underwriting needed as long as superior payments depend on date though the premium gradually increases gradually. This is an excellent alternative for those who might want short-lived protection.

Some individuals feel it is very important to buy life insurance coverage when they get their very first job, while others wait up until they have a family to support. Whatever your motivation for acquiring life insurance, there are reasons it's smart to get guaranteed early. An insurance plan helps protect your loved ones financially.

This is especially essential for those who have actually co-signed loan documents with you and would need to take over payments after your death. As you continue to move on in your profession, your earnings will rise but your premium will remain the same if you have actually selected an ensured policy. When you register for term life insurance, your policy will have a death benefit.

If you die throughout the covered term, the life insurance coverage business will pay your recipients the whole survivor benefit as long as it wasn't an excluded cause of death and premiums are paid. Your beneficiaries can receive a check for the whole amount. If they don't desire to receive that much money at when, they can likely ask for to be paid in installations.

Term life insurance is short-lived coverage. It will only last during the policy's stated term, and your protection will end if you outlive this duration. On the other hand, permanent life insurance coverage might last your entire life as long as you stay up to date with the premiums. Since irreversible life insurance coverage can last longer, these policies typically begin charging a higher premium than term life insurance coverage.

Not known Details About What Is The Minimum Insurance Requirement In California?

In contrast, there are some irreversible policies where the premium always stays the exact same after you sign up. One other key distinction is money worth. This is an extra benefit on some long-term life insurance coverage policies that develops money you can get or borrow while you're still alive.

Some Known Incorrect Statements About How To Get Dental Implants Covered By Insurance

Lots of people buy term protection when they remain in their 20s due to the fact that it appears more inexpensive when compared to a cash value life insurance policy with the very same survivor benefit quantity. By the time they remain in their 40s, the coverage seems a bit pricey, as the rate goes up. In their 50s, the expense has usually overtaken the expense of irreversible protection.

Meanwhile, the individual who might have paid more for that long-term policy in his/her 20s may still be paying the very same premium. That's why the term policy's conversion advantage is so crucial. This valuable function is normally available in the first couple of years of the policy, and allows you to transform to permanent insurance coverage without sending evidence of insurability.

The worth of long-term life insurance. Cash value life insurance can be a strong long-term solution for many individuals. The factors: Cash worth life insurance provides life-long insurance coverage defense, offered premiums are paid. With couple of exceptions, as soon as you have actually been approved for the protection, your policy can not be canceled by the provider.

Despite higher initial premiums, money value life insurance coverage can actually be CHEAPER than term in the long run. A lot of long-term policies are eligible for dividends, which are not ensured, if and when they are declared by the insurance provider. Numerous companies use the alternative to use current and accumulated dividend values towards payment of all or part of the premiums.

So while premiums need to be paid under both the irreversible and term insurance coverage plans, long-lasting out-of-pocket cost of irreversible life insurance might be lower compared to the overall cost for a term policy. It can remove the problem of future insurability. Cash value life insurance coverage does not end after a specific period of time.

It builds MONEY WORTH. This amountpart of which is guaranteed under numerous policiescan be used in the future for any purpose you want. If you like, you can obtain money worth for a down payment on a home, to assist spend for your children's education, or to provide earnings for your retirement.

An Unbiased View of How Long Can My Child Stay On My Health Insurance

As you reach a number of life's major milestones, you may discover yourself paying more attention to the concern of life insurance. https://timesharecancellations.com/test/ While it might not constantly be a simple topic to discuss, its advantages might assist your family settle expenses and assist provide peace of mind when you're gone.

Here, we have actually covered the fundamentals of term life insurance coverage to assist you choose if this is the right policy for you. Amongst the different types of life insurance coverage, term life insurance is typically considered as one of the most affordable options. Term life insurance coverage pays an advantage if you pass away during the insurance coverage duration.

The premium must be paid in a timely manner for the policy to stay active. The length of term life insurance coverage depends on what policy you buy. For instance, if you purchased a policy that lasted for five years, you would be covered the whole time unless you were to stop paying your premiums.

Insurer might also set a maximum age limit for how long the policy can last. Term life insurance covers death from most causes, however there are a few exceptions when a term life insurance coverage policy might not cover you. These are called exclusions and will be detailed in your policy.

Term life insurance likewise might not cover somebody who lied or left info off their application that was associated with their ultimate cause of death. For lots of people, the main benefit of a term life insurance coverage policy is its rate. These policies tend to be cheaper than long-term life insurance coverage policies - why is my car insurance so high.

Throughout this time, your premiums will stay the same. Term life insurance is also fairly simple to understand. You pay a premium, and then your beneficiaries get the death advantage if you die as long as premiums have actually been paid. Other policies may have more functions and advantages that might take a little bit more research to understand.

What Does How Much Is A Unit Of Colonial Penn Life Insurance? Mean?

There are 2 fundamental classifications of term life insurance: ensured level and renewable/convertible. These categories are not mutually exclusive. An ensured level term policy is a popular option because the premium remains the exact same for the whole policy length. With no price boosts throughout this term, it uses an economical method to purchase life insurance coverage.

A renewable/convertible life insurance coverage policy can be either short-term or extended. As its name recommends, an eco-friendly policy can be regularly restored without any additional underwriting required as long as premium payments are up to date though the premium gradually increases gradually. This is an excellent choice for those who might want short-term protection.

Some individuals feel it is essential to buy life insurance coverage when they get their very first task, while others wait until they have a family to support. Whatever your motivation for acquiring life insurance, there are factors it's smart to get insured early. An insurance coverage policy helps secure your enjoyed ones economically.

This is especially crucial for those who have co-signed loan documents with you and would need to take over payments after your death. As you continue to progress in your profession, your earnings will increase however your premium will remain the exact same if you've selected a guaranteed policy. When you sign up for term life insurance, your policy will have a survivor benefit.

If you pass away during the covered term, the life insurance coverage company will pay your recipients the whole death advantage as long as it wasn't an excluded cause of death and premiums are paid. Your beneficiaries can receive a check for the entire amount. If they do not want to receive that much money at once, they can likely ask for to be paid in installations.

Term life insurance is short-term protection. It will only last during the policy's mentioned term, and your coverage will end if you outlast this period. On the other hand, permanent life insurance coverage might last your whole life as long as you keep up with the premiums. Because long-term life insurance can last longer, these policies typically start out charging a greater premium than term life insurance.

8 Easy Facts About How Much Is The Penalty For Not Having Health Insurance Explained

In comparison, there are some irreversible policies where the premium always remains the same after you sign up. One other essential distinction is money worth. This is an additional benefit on some permanent life insurance policies that develops money you can take out or borrow while you're still alive.

Getting The How Much Is Life Insurance Per Month To Work

Economic conditions change quickly, and lots of people feel overloaded about preparing for future monetary security. Individual monetary consultants assist to minimize anxiety by using financial investment advice to individuals who are just beginning their careers along with those who are all set to retire. These financial professionals hold positions of trust, and their highest professional top priority is their customers' best interests.

Financial Market Regulatory Authority licensing requirements to work with customers. After seeking advice from clients about their present scenarios and long-term objectives, individual financial consultants assist customers to produce plans that keep them moving forward financially. This often involves producing portfolios that consist of a mix of stocks, bonds, insurance items, and shared funds.

You'll also do periodic reviews of client portfolios to ensure that picked financial investment items are still relevant. Although many individual financial advisors have financing degrees, some hold accounting and law qualifications. Excellent pay and the chance to assist people to take control of their monetary futures aren't the only attractions to the personal financial advisor profession field.

As an individual monetary http://trevorkteq359.tearosediner.net/a-biased-view-of-how-to-find-a-deceased-person-s-life-insurance-policy consultant, you can work for financial services companies or as a self-employed expert. Considering that numerous of your clients work throughout the day, your schedule needs to be flexible enough to accommodate night and weekend work. While personal financial experts help the public to make sound financial investment decisions, financial analysts give corporations, banks, and government companies financial jon and amanda d'aleo investment recommendations.

The majority of the time it takes more than an excellent product and marketing expertise to take a company position in a competitive market. Financial analysts offer companies an edge by providing forecasts that are based on business and industry financial data (what type of life insurance are credit policies issued as). As a monetary expert, you'll deal with senior leaders to generate policies that optimize company budgets.

When you have historical information, you'll do difference evaluations to make certain that your company's expenses result in achievement of its strategic objectives and monetary objectives. After examining sets of monetary data, you'll find trends that support choices about expansion into new markets or product development. As a monetary analyst you'll need these abilities: Quantitative analysis Composed communication Verbal interaction and discussion Computer system application and database As a financial analyst, you'll develop strong interpersonal abilities as you deal with colleagues and management at all levels to present analytical findings.

The 5-Second Trick For Which Is Better Term Or Whole Life Insurance?

While your financing degree is a fantastic calling card for a job in this profession field, think about earning a credential such as the Qualified Financial Modeling and Appraisal Expert to prove your dedication to professional advancement and to stay ahead of the competitors. An investment banker deal with corporations and government companies to raise money in the capital markets; he or she also functions as a consultant throughout merger and acquisition efforts.

It does not have the liquid possessions to pay for the effort in advance, or they have actually decided against draining their money reserves to make the effort occur. A business such as this one could choose to release bonds or stocks to get large amounts of cash for its project. Federal government firms regularly offer bonds to raise funds for expensive construction projects such as brand-new roadways, bridges, and municipal structures.

Securities and Exchange Commission rules. Financial investment banking jobs are notoriously challenging. You'll require these abilities to be a successful financial investment banker: Financial modeling and analysis Presentation and interaction Leadership Entrepreneurial Diplomacy Imagination As an investment banker, you'll price stocks and bonds utilizing assessment models. If you cost investment items expensive, you won't get the need for them that your client desires.

Your efficiency straight affects your overall pay in the form of perks. While the yearly base pay for entry-level investment lenders starts at $85,000, some junior analysts reach base incomes of $100,000 annually at leading firms. Performance perks allow them to almost double their incomes. You can anticipate to stash your social life for a few years and hang on to your ethics training.

Statisticians use theoretical or applied analytical techniques to gather, test, analyze, and sum up data for reports. Their findings are used to enhance products, service results, and business decisions in numerous markets such as health care, federal government services, monetary services, education, and even sports. Every market values analytical abilities given that each company relies on truths to make educated decisions.

The results of your work help the healthcare market to assess the basic conditions of health for regional and nationwide populations. The market utilizes these statistical findings to justify investments in certain health care initiatives. If healthcare agencies find that there has actually been a disconcerting increase in Type 2 diabetes in children, they might utilize your analytical findings to justify funding for instructional programs that advocate for healthy eating options for kids.

The Best Guide To How Does Whole Life Insurance Work

The information points that you collect about the video game offer coaches, group owners, gamers, and their fans a birds-eye view of how a gamer carries out in a particular location of his/her sport. Made run averages, runs batted in, and assists per game are popular information points that statisticians determine.

As a statistician, you'll enjoy excellent pay while operating in reasonably low-stress environments. Statisticians who work for the Bureau of Labor Statistics forecast that task development rates in this profession field will increase faster than ones in lots of other profession fields in the near future. A spending plan analyst arranges funding for public and personal firms.

When an organization's leaders desire to execute a brand-new services or product, they speak with spending plan analysts to create financing requests for the brand-new products. Budget plan analysts give recommendations about program financing that line up with company objectives, market requirements, and federal government regulations. Absolutely nothing causes budget analysts and their bosses more anxiety than inaccurate reports.

A budget plan analyst who asks for task labor funding for three service technicians risks having the project begin late or not at all if the task actually requires four service technicians to do the work. Besides careful attention to information, budget analysts need these skills to make it through in their profession field: Spreadsheet information modeling Oral interaction and discussion Composing Mathematics and quantitative analysis Capability to focus under pressure As a budget expert, you'll have chances to operate in lots of industries such as info technology, engineering services, defense, and education.

As a public sector spending plan analyst, your work will optimize spending plans for improved program performance. A spending plan expert's task tasks generally differ with experience. Seasoned budget experts Home page in corporations offer reports to C-suite executives while their peers in government service often present monetary information to law makers. Each time that you purchase a fresh salad from the grocery shop or score a stylish pair of shoes from your preferred merchant you benefit from the work of logisticians.

Logisticians are sometimes called supply chain supervisors, and they often work for national and international shipping companies. As a logistician, you'll perform activities that need attention to detail as well as big-picture methods. You'll direct supply purchases, schedule transportation, and coordinate storage at warehouses. You'll also utilize social abilities to cultivate efficient, enduring relationships with providers, customers, and freight suppliers.

The smart Trick of Why Do I Need Life Insurance That Nobody is Talking About

Economic conditions alter quickly, and lots of people feel overloaded about planning for future financial security. Personal monetary advisors help to reduce anxiety by providing financial investment recommendations to people who are simply beginning their professions along with those who are prepared to retire. These monetary specialists hold positions of trust, and their highest expert top priority is their customers' benefits.

Financial Industry Regulatory Authority licensing requirements to deal with customers. After seeking advice from customers about their current situations and long-lasting objectives, individual monetary advisors help clients to create strategies that keep them moving forward financially. This typically involves creating portfolios that include a mix of stocks, bonds, insurance products, and shared funds.

You'll also do regular reviews of client portfolios to make sure that chosen financial investment items are still pertinent. Although many individual monetary consultants have financing degrees, some hold accounting and law credentials. Excellent pay and the opportunity to assist people to take control of their monetary futures aren't the only destinations to the personal monetary advisor career field.

As an individual monetary consultant, you can work for monetary services business or as a self-employed specialist. Considering that a lot of your clients work throughout the day, your schedule should be flexible adequate to accommodate night and weekend work. While personal monetary analysts assist the public to make sound financial investment choices, financial analysts give corporations, banks, and government companies investment advice.

Many of the time it takes more than a terrific product and marketing expertise to take a company position in a competitive market. Financial analysts provide organizations an edge by using forecasts that are based upon company and market monetary data (what is the purpose of life insurance). As Home page a monetary analyst, you'll work with senior leaders to generate policies that optimize company budget plans.

When you have historical data, you'll do difference assessments to ensure that your company's expenses result in achievement of its tactical objectives and financial objectives. After assessing sets of financial data, you'll find trends that support decisions about expansion into brand-new markets or item advancement. As a financial expert you'll require these abilities: Quantitative analysis Written interaction Verbal interaction and discussion Computer system application and database As a monetary analyst, you'll develop strong interpersonal skills as you work with coworkers and management at all levels to present analytical findings.

Indicators on What Is Life Insurance Corporation You Should Know

While your finance degree is a great calling card for a task in this career field, consider making a credential such as the Licensed Monetary Modeling and Assessment Analyst to prove your dedication to professional advancement and to stay ahead of the competitors. An financial investment lender deal with corporations and federal government companies to raise money in the capital markets; he or she likewise serves as a consultant throughout merger and acquisition initiatives.

It doesn't have the liquid properties to pay for the initiative up front, or they have actually decided against draining their cash reserves to make the effort occur. A business such as this one might opt to provide bonds or stocks to get large amounts of money for its task. Government firms regularly sell bonds to raise funds for costly building and construction tasks such as brand-new roads, bridges, and municipal structures.

Securities and Exchange Commission guidelines. Investment banking jobs are notoriously difficult. You'll require these abilities to be a successful financial investment banker: Financial modeling and analysis Presentation and communication Leadership Entrepreneurial Diplomacy Creativity As an investment lender, you'll price stocks and bonds using evaluation models. If you price financial investment items too expensive, you will not get the need for them that your customer wants.