What Does How To Check If Your Health Insurance Is Active Online Do?

Premium tax credits will be readily available in 2021 for people who qualify. Consumers can continue to use Exchange protection and make the most of its advantages, including superior tax credits. Strategies offered from insurer will continue to show decreased copayments, coinsurance, and deductibles for eligible consumers. Similar to previous years, small company companies will have the ability to enlist straight with a company, or with a SHOP-registered agent or broker.

gov enables companies to preview available SHOP plans and discover a provider or agent/broker to work with to use STORE protection to their workers. Quality ranking details will also be available for STORE plans. Each year, the Federal Health Insurance Exchange sends out notices to consumers who are presently registered in a Marketplace strategy prior to November 1 about the upcoming Open Registration Period.

The notice also provides consumers with tailored messaging for their scenario, such as if they're at danger of losing superior tax credits. Consumers get extra Website link notices from their current issuer with essential details about premiums, protection and advantage modifications, and plan schedule for 2021. To see examples of customer notices, visit: https://marketplace.

html Similar to previous years, present enrollees who do not upgrade their application and register in a strategy by the December 15, 2020 Open Enrollment deadline typically will be instantly registered in the exact same plan or another strategy offered by the same provider that is planned to be comparable, and if that is not offered, another plan with a different insurer - which of the following best describes how auto insurance companies manage risk?.

Consumers who miss out on the deadline to actively re-enroll in a plan of their option during Open Registration will not be able to make any plan changes till the next protection year unless they get approved for particular Unique Registration Periods. The Exchange sends a notification informing customers who were immediately re-enrolled (how to check if your health insurance is active online).

Those customers might also get a letter from the Exchange alerting them that they have been matched with an alternate strategy from a various issuer to assist prevent a space in coverage. These consumers usually will require to pay their premium for January in order for their 2021 protection to begin.

The 5-Second Trick For How Much Home Insurance Do I Need

Customers whose issuer isn't using their plan in 2021 are qualified for a Special Enrollment Duration due to losing protection and have the chance to select a various strategy. CMS prepares to invest $10 million on marketing and outreach for the upcoming Open Enrollment Period, matching the exact same level of costs for the past a number of years.

This year's outreach and education project will target people who are uninsured as well as those preparing to reenroll in health insurance, with an unique concentrate on young and healthy consumers. CMS has devoted resources to proven high effect, low expense digital outreach efforts consisting of short YouTube videos, social media, and mobile and search advertising.

Targeted e-mail has actually shown to be the most cost effective and reliable way to reach consumers. As part of this effort, CMS will send out most customers emails throughout every week, with increasing frequency as the December 15 due date methods. CMS will likewise reinforce academic messaging through ongoing text messages and offer pointer calls motivating consumers to Click here for more take action prior to the deadline.

Maintenance will just happen within these windows when deemed essential to provide consumers with a better shopping experience. Consumer access to HealthCare. gov may be limited or limited when this maintenance is required. Routinely scheduled maintenance will continue to be prepared for the lowest-traffic period on Health care. gov, which are Sunday early mornings.

Like other IT systems, these scheduled upkeep windows are how CMS updates and improves our system to run efficiently and are the regular course of business. For more details on the arranged upkeep times, check out: https://marketplace. cms.gov/ technical-assistance-resources/2021-open-enrollment- healthcaregov-maintenance-windows. pdf Similar to previous years, CMS might deploy a "waiting space" for some customers who are logging in or producing an account on HealthCare.

The waiting space is one tool CMS utilizes to optimize a consumers' experience due to the fact that it enables CMS to manage the volume of users on Health care. gov leading to better performance of the website. If they are in a waiting space, customers will see a message asking them to remain on the page.

All about What Is A Certificate Of Insurance

Comparable to previous years, CMS plans to launch weekly enrollment snapshots throughout the Open Registration Period. To view the 2021 Medical insurance Exchange Premium Landscape Issue Brief, visit: To learn more on 2021 private and family health insurance readily available in the Federal Health Insurance coverage Exchange, visit: https://www. healthcare.gov/ health-and-dental-plan-datasets-for-researchers-and-issuers/ To see the 2021 Health Insurance Coverage Exchange Public Usage Files, visit: https://www.

Open registration is an amount of time each year when you can sign up for medical insurance or change your plan (if your strategy is provided by a company, open registration is likewise an opportunity to disenroll if you no longer desire the coverage). If you do not sign up for medical insurance throughout open registration, you probably can't register for medical insurance until the next open registration duration, unless you experience a certifying event.

The business is not allowed to use medical underwriting or require proof of insurability, both of which might make it harder for you to get health insurance coverage. Open enrollment durations are utilized for a lot of types of health insurance coverage, consisting of: The time of year for open registration depends upon the healthcare plan you pick: Medicare open registration (for Medicare Benefit and Part D prepares) runs from October 15 to December 7 each year, and there is a separate open registration duration from January 1 to March 31 for http://franciscojjij999.wpsuo.com/the-facts-about-how-does-health-insurance-deductible-work-revealed individuals who already have Medicare Benefit.

Medigap strategies are just readily available without medical underwriting throughout your initial registration period or throughout one of the really minimal special registration durations that use to those strategies, although a few states have executed guidelines that allow Medigap enrollees to make modifications to their intend on an annual basis. Job-based medical insurance open registration periods are set by your company and can take place at any time of the year.

However some companies choose to have a health insurance year that doesn't line up with the fiscal year, so for example, you may discover that your company provides open registration in June, with a new strategy year that begins in August. Open enrollment in the private market (on and off-exchange) ranges from November 1 to December 15 in many states.

gov, which is the exchange platform that's utilized in 38 states since 2020 (dropping to 36 for 2021, as Pennsylvania and New Jersey will be running their own exchange platforms). The District of Columbia and the other 12 states (14 in 2021) have more flexibility with their registration schedules, and many of them tend to provide longer enrollment windows. how much should i be paying for car insurance.

An Unbiased View of What Does An Insurance Underwriter Do

Keep in mind that Native Americans can register in specific market health strategies through the exchange year-round, and are not limited to the annual open registration duration. Prior to 2014, registration was offered year-round in the individual market, however in a lot of states insurance companies determined eligibility based upon candidates' case history, which suggested individuals with pre-existing conditions might be denied coverage; that no longer takes place, thanks to the ACA.

What Does How To Find Out If Someone Has Life Insurance Do?

Premium tax credits will be available in 2021 for people who qualify. Consumers can continue to use Exchange protection and make the most of its benefits, including premium tax credits. Strategies offered from insurance provider will continue to reflect lowered copayments, coinsurance, and deductibles for eligible consumers. Similar to previous years, small business companies will have the ability to register straight with an issuer, or with a SHOP-registered representative or broker.

gov enables companies to preview readily available SHOP plans and find a provider or agent/broker to deal with to offer SHOP coverage to their staff members. Quality ranking info will also be readily available for STORE plans. Each year, the Federal Medical insurance Exchange sends notices to consumers who are presently enrolled in a Market strategy prior to November 1 about the upcoming Open Enrollment Period.

The notice also offers customers with personalized messaging for their situation, such as if they're at danger of losing superior tax credits. Consumers get additional notices from their existing issuer with important Website link details about premiums, coverage and benefit modifications, and strategy schedule for 2021. To see examples of customer notifications, see: https://marketplace.

html Comparable to previous years, present enrollees who do not update their application and register in a plan by the December 15, 2020 Open Registration deadline typically will be immediately registered in the same strategy or another plan provided by the exact same provider that is intended to be similar, and if that is not offered, another plan with a various insurer - when does car insurance go down.

Customers who miss the deadline to actively re-enroll in a strategy of their option throughout Open Enrollment will not have the ability to make any strategy modifications up until the next coverage year unless they receive certain Special Registration Periods. The Exchange sends out a notification alerting consumers who were instantly re-enrolled (how much is an eye exam without insurance).

Those customers might also receive a letter from the Exchange alerting them that they have been matched with an alternate plan from a various company to assist prevent a gap in coverage. These customers generally will require to pay their premium for January in order for their 2021 protection to begin.

5 Easy Facts About Which Of The Following Best Describes Annually Renewable Term Insurance Explained

Consumers whose provider isn't providing their plan in 2021 are eligible for a Special Enrollment Duration due to losing protection and have the chance to pick a different plan. CMS plans to spend $10 million on marketing and outreach for the upcoming Open Enrollment Duration, matching the exact same level of spending for the http://franciscojjij999.wpsuo.com/the-facts-about-how-does-health-insurance-deductible-work-revealed previous a number of years.

This year's outreach and education project will target people who are uninsured along with those preparing to reenroll in health insurance, with a special concentrate on young and healthy consumers. CMS has actually committed resources to tested high impact, low cost digital outreach efforts consisting of brief YouTube videos, social media, and mobile and search advertising.

Targeted e-mail has proven to be the most cost efficient and efficient method to reach consumers. As part of this effort, CMS will send most customers emails throughout every week, with increasing frequency as the December 15 due date approaches. CMS will likewise enhance academic messaging through ongoing text messages and supply suggestion Click here for more calls encouraging customers to take action before the deadline.

Upkeep will just happen within these windows when deemed necessary to offer customers with a much better shopping experience. Consumer access to Health care. gov might be limited or limited when this upkeep is needed. Routinely arranged upkeep will continue to be prepared for the lowest-traffic period on HealthCare. gov, which are Sunday early mornings.

Like other IT systems, these set up upkeep windows are how CMS updates and improves our system to run efficiently and are the typical course of organization. For additional information on the set up maintenance times, check out: https://marketplace. cms.gov/ technical-assistance-resources/2021-open-enrollment- healthcaregov-maintenance-windows. pdf Similar to previous years, CMS may deploy a "waiting room" for some customers who are logging in or creating an account on HealthCare.

The waiting room is one tool CMS utilizes to optimize a customers' experience due to the fact that it allows CMS to control the volume of users on Health care. gov leading to better efficiency of the site. If they are in a waiting room, customers will see a message asking to remain on the page.

The Ultimate Guide To How Much Does A Doctor Visit Cost Without Insurance

Similar to previous years, CMS plans to release weekly enrollment pictures throughout the Open Enrollment Period. To see the 2021 Health Insurance Exchange Premium Landscape Issue Quick, see: For additional information on 2021 private and household health plans readily available in the Federal Medical Insurance Exchange, visit: https://www. healthcare.gov/ health-and-dental-plan-datasets-for-researchers-and-issuers/ To see the 2021 Medical insurance Exchange Public Use Files, visit: https://www.

Open registration is a time period each year when you can register for health insurance coverage or change your plan (if your strategy is supplied by a company, open registration is also an opportunity to disenroll if you no longer desire the coverage). If you do not register for health insurance coverage during open registration, you probably can't sign up for health insurance until the next open enrollment duration, unless you experience a certifying event.

The business is not allowed to use medical underwriting or require evidence of insurability, both of which might make it harder for you to get health insurance. Open enrollment durations are utilized for a lot of kinds of health insurance, including: The time of year for open registration depends on the healthcare strategy you pick: Medicare open enrollment (for Medicare Benefit and Part D prepares) runs from October 15 to December 7 each year, and there is a separate open enrollment period from January 1 to March 31 for individuals who currently have Medicare Advantage.

Medigap plans are only available without medical underwriting during your initial enrollment period or during among the extremely restricted special enrollment durations that apply to those plans, although a couple of states have actually carried out guidelines that allow Medigap enrollees to make changes to their intend on an annual basis. Job-based health insurance coverage open registration periods are set by your company and can take place at any time of the year.

However some employers pick to have a health strategy year that doesn't align with the fiscal year, so for example, you may discover that your employer offers open enrollment in June, with a new plan year that starts in August. Open registration in the specific market (on and off-exchange) runs from November 1 to December 15 in a lot of states.

gov, which is the exchange platform that's utilized in 38 states since 2020 (dropping to 36 for 2021, as Pennsylvania and New Jersey will be running their own exchange platforms). The District of Columbia and the other 12 states (14 in 2021) have more versatility with their enrollment schedules, and the majority of them tend to use longer registration windows. how much does an eye exam cost without insurance.

Some Known Facts About What Does Comprehensive Auto Insurance Cover.

Note that Native Americans can register in specific market health plans through the exchange year-round, and are not limited to the yearly open enrollment period. Prior to 2014, enrollment was readily available year-round in the private market, but in a lot of states insurers determined eligibility based on applicants' medical history, which meant individuals with pre-existing conditions could be denied protection; that no longer occurs, thanks to the ACA.

The Best Strategy To Use For How Do Health Insurance Deductibles Work

Whether your workforce.

is still working from another location, going back to your worksites or throughout between, in this webcast you will find out how virtual registration will permit your workers to make educated choices and adapt to new truths no matter where they're situated. Open Enrollment Resources Examine out and share the health advantage terms glossary here on SHRM.org.

are an excellent way to encourage employees to consider health and relationship changes before making their open enrollment choices. More companies are making high-deductible health plans an alternative( or, progressively, the sole choice) for employer-sponsored health protection. Here is a fast guide on how to help employees comprehend the expenses and advantages. Mandatory Health Insurance Notices For the lots of companies.

in the middle of open registration planning, SHRM has put together model health insurance notices from federal government firms. 2021 Inflation-Adjusted Limits & Thresholds Our updated 2021 benefit plan limits and thresholds chart, with significant cost of living modifications and links to appropriate SHRM content. Throughout open registration, highlight the contribution cap and encourage employees to think about a greater cost savings rate, retirement advisors recommend. Employees in 2021 can once again put up to $ 2,750 into their health care versatile spending accounts (FSAs) pretax, the IRS revealed. Benefit limits for adoption help, transit advantages, and certified small employer HRAs were also released. When we describe off-exchange plans, we're only speaking about major medical coverage the strategies to which ACA regulations apply. A plethora of "excepted benefit" plans (such as short-term health insurance) are likewise offered outside the exchanges in a lot of states, and are exempt from ACA regulations. But our conversation of off-exchange plans just refers to ACA-compliant strategies sold outside the exchanges.

And the exact same open enrollment window November 1 to December 15 in a lot of states applies no matter whether the plan is sold in the exchange our outside the exchange. However the ACA's premium subsidies and cost-sharing decreases are just available if you purchase a strategy in the exchange. If you buy the exact same plan directly from the insurance business (ie, off-exchange), you'll have to pay complete rate, there will be no cost-sharing reductions readily available, and you won't have an option to claim the premium tax credit when you submit your tax return the following year.

If you wonder about off-exchange health plans, this FAQ provides a more thorough look at how they're controlled and the reasons some individuals pick off-exchange plans. If your present health insurance policy is not grandfathered but was in result prior to 2014, your plan is thought about a transitional health insurance or "grandmothered policy." These plans are not totally ACA-compliant, and were bought between March 23, 2010 when the ACA was signed into law and completion of 2013.

5 Simple Techniques For How Much Does A Tooth Implant Cost With Insurance

Transitional health plans were initially slated to end in 2014. But extensions have been approved by the federal government every year, allowing these strategies to stay in force if the state concurs and if the insurance company still wishes to restore the strategies. The latest extension enables transitional health strategies to https://www.ripoffreport.com/report/s/wesley-financial-group-llc-trusted-business-ripoff-report-verified-896644 renew up till October 1, 2021, and stay in force till the end of 2021.

( In the staying states, these plans were either needed to terminate or insurers voluntarily ended them and changed them with ACA-compliant coverage.) If you're enrolled in a transitional strategy and your insurer is offering renewal for 2021, you have the alternative to keep your prepare for another year. But it's certainly in your benefit to thoroughly compare your plan with the brand-new options that are offered in the ACA-compliant market for 2021.

( Premium aids for 2021 are available for a single person with an earnings approximately $51,040. In 2014, a single person could only qualify for aids with an income of approximately $45,960; as the hardship level increases each year, so does the income cap for subsidy eligibility.) And the ACA-compliant strategies offered now are likely to supply more robust protection including all of the vital health benefits than the plan you purchased prior to 2014.

She has actually composed dozens of viewpoints and instructional pieces about the Affordable Care Act for healthinsurance. org. Her state health exchange updates are regularly pointed out by media who cover health reform and by other medical insurance professionals.

In the majority of states, open enrollment for 2021 protection will run from November 1 to December 15, 2020, with all plans reliable January 1, 2021. Open registration for 2021 protection ended on December 15, 2020 in the majority of states. California, Colorado, and Washington, DC, have permanently extended open registration. State-run exchanges have flexibility to make OEP longer.

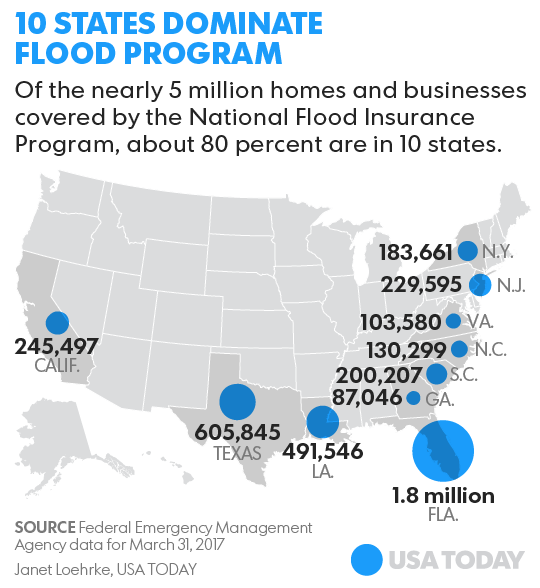

Health care. gov, which is the exchange platform that's used by the bulk of the states, tends to follow this schedule relatively closely, while the states that run their own exchange platforms typically provide somewhat longer registration windows. how much does flood insurance cost. HealthCare. gov is being used in 36 states for registration in 2021 health plans (it was 38 states as of 2020, but Pennsylvania and New Jersey have actually both transitioned to their own enrollment platforms as of the fall of 2020; both have actually likewise chosen to extend their open registration windows).

How Much Is Health Insurance A Month For A Single Person? - An Overview

And many of the other totally state-run exchanges have actually decided to extend the open enrollment duration for 2021 coverage, implying it will continue past December 15. Outside of open registration, plan changes and new registrations are just possible for individuals who experience a qualifying occasion. Native Americans and Alaska Natives can enlist year-round in plans provided in the exchange.

In the following states, open registration ended on December 15 (although due to high call volume on December 15, Health care. gov had some callers leave their contact information; the exchange will call these people back over the next couple of days to complete their registration in 2021 coverage): California enacted legislation in 2017 and again in 2019 that completely develops various registration dates within the state, both on and off-exchange.

California's registration schedule has varied in previous years, however this three-month window, from the beginning of November through completion of January, will be the irreversible enrollment window going forward. Colorado's Division of Insurance coverage has actually likewise permanently extended open enrollment. The state completed regulations in late 2018 that require a yearly special https://www.glassdoor.com/Overview/Working-at-Wesley-Financial-Group-EI_IE1950034.11,33.htm registration period, running from December 16 to January 15, that is contributed to the end of open enrollment each year.

The Ultimate Guide To How Much Does Health Insurance Cost Per Month

Whether your workforce.

is still working remotely, returning to your worksites or anywhere in between, in this webcast you will find out how virtual registration will allow your workers to make educated decisions and adapt to brand-new truths no matter where they lie. Open Registration Resources Have a look at and share the health benefit terms glossary here on SHRM.org.

are a fantastic method to encourage staff members to consider health and relationship changes before making their open enrollment selections. More companies are making high-deductible health plans an option( or, increasingly, the sole choice) for employer-sponsored health protection. Here is a fast guide on how to assist employees comprehend the expenses and benefits. Mandatory Health Insurance Notices For the many employers.

in the midst of open registration planning, SHRM has actually assembled design health strategy notifications from federal government companies. 2021 Inflation-Adjusted Limits & Thresholds Our updated 2021 benefit plan limits and thresholds chart, with significant cost of living changes and links to relevant SHRM material. During open enrollment, highlight the contribution cap and encourage staff members to think about a greater cost savings rate, retirement consultants advise. Staff members in 2021 can once again put up to $ 2,750 into their healthcare flexible costs accounts (FSAs) pretax, the Internal Revenue Service revealed. Benefit limitations for adoption assistance, transit benefits, and qualified little employer HRAs were likewise launched. When we describe off-exchange strategies, we're just discussing major medical coverage the strategies to which ACA policies apply. A plethora of "excepted advantage" plans (such as short-term medical insurance) are also sold outside the exchanges in many states, and are exempt from ACA guidelines. However our conversation of off-exchange strategies just describes ACA-compliant strategies sold outside the exchanges.

And the exact same open registration window November 1 to December 15 in the majority of states uses despite whether the plan is sold in the exchange our outside the exchange. But the ACA's premium aids and cost-sharing decreases are just available if you purchase a strategy in the exchange. If you purchase the exact very same strategy straight from the insurer (ie, off-exchange), you'll need to pay full rate, there will be no cost-sharing reductions offered, and you won't have an alternative to declare the premium tax credit when you file your tax return the following year.

If you wonder about off-exchange health insurance, this Frequently Asked Question uses a more thorough appearance at how they're managed and the factors some individuals select off-exchange plans. If your current health insurance policy is not grandfathered but was in impact prior to 2014, your plan is considered a transitional health insurance or "grandmothered policy." These plans are not completely ACA-compliant, and were purchased in between March 23, 2010 when the ACA was signed into law and completion of 2013.

Some Ideas on I Need Surgery And Have No Insurance Where Can I Get Help You Need To Know

Transitional health insurance were initially slated to end in 2014. However extensions have been approved by the federal government every year, enabling these strategies to stay in force if the state concurs and if the insurance provider still desires to restore the plans. The most current extension permits transitional health insurance to restore up until October 1, 2021, and remain in force up until completion of 2021.

( In the staying states, these strategies were either needed to end or insurance providers voluntarily ended them and replaced them with ACA-compliant protection.) If you're enrolled in a transitional strategy and your insurance provider is offering renewal for 2021, you have the alternative to keep your plan for another year. However it's absolutely in your best interest to thoroughly compare your strategy with the new alternatives that are available in the ACA-compliant market for 2021.

( Premium subsidies for 2021 are available for a single person with an earnings as much as $51,040. In 2014, a single individual might only qualify for aids with an income of as much as $45,960; as the hardship level increases each year, so does the income cap for aid eligibility.) And the ACA-compliant strategies readily available now are most likely to supply more robust protection consisting of all of the necessary health advantages than the strategy you bought prior to 2014.

She has actually composed dozens of viewpoints and instructional pieces about the Affordable Care Act for healthinsurance. org. Her state health exchange updates are routinely cited by media who cover health reform and by other health insurance experts.

In most states, open registration for 2021 coverage will run from November 1 to December 15, 2020, with all strategies reliable January 1, 2021. Open enrollment for 2021 coverage ended on December 15, 2020 in many states. California, Colorado, and Washington, DC, have permanently extended open registration. State-run exchanges have versatility to make OEP longer.

Health care. gov, which is the exchange platform that's used by the majority of the states, tends to follow this schedule fairly closely, while the states that run their own exchange platforms normally provide a little longer registration windows. how to get cheap car insurance. Health care. gov is being used in 36 states for registration in 2021 health insurance (it was 38 states https://www.ripoffreport.com/report/s/wesley-financial-group-llc-trusted-business-ripoff-report-verified-896644 since 2020, but Pennsylvania and New Jersey have both transitioned to their own registration platforms since the fall of 2020; both have likewise opted to extend their open https://www.glassdoor.com/Overview/Working-at-Wesley-Financial-Group-EI_IE1950034.11,33.htm enrollment windows).

What Does What Is The Best Dental Insurance Do?

And many of the other fully state-run exchanges have actually decided to extend the open enrollment duration for 2021 coverage, implying it will continue past December 15. Beyond open enrollment, strategy changes and brand-new enrollments are only possible for individuals who experience a certifying occasion. Native Americans and Alaska Natives can enroll year-round in plans offered in the exchange.

In the following states, open registration ended on December 15 (although due to high call volume on December 15, Health care. gov had some callers leave their contact information; the exchange will call these individuals back over the next few days to finish their registration in 2021 coverage): California enacted legislation in 2017 and once again in 2019 that permanently establishes various enrollment dates within the state, both on and off-exchange.

California's enrollment schedule has actually differed in previous years, but this three-month window, from the beginning of November through completion of January, will be the permanent enrollment window moving forward. Colorado's Department of Insurance has actually likewise completely extended open registration. The state finalized guidelines in late 2018 that require a yearly special registration duration, running from December 16 to January 15, that is included to completion of open registration each year.

The smart Trick of Why Is Car Insurance So Expensive That Nobody is Discussing

Whether your labor force.

is still working from another location, returning to your worksites or anywhere in between, in this webcast you will find out how virtual registration will permit your workers to make educated decisions and adapt to brand-new truths no matter where they lie. Open Registration Resources Take a look at and share the health benefit terms glossary here on SHRM.org.

are an excellent method to motivate workers to consider health and relationship changes before making their open registration choices. More companies are making high-deductible health prepares an option( or, increasingly, the sole option) for employer-sponsored health coverage. Here is a quick guide on how to help employees understand the expenses and advantages. Mandatory Health Strategy Notices For the lots of companies.

in the middle of open registration preparation, SHRM has assembled design health insurance notifications from federal government companies. 2021 Inflation-Adjusted Limits & Thresholds Our updated 2021 advantage plan limitations and limits chart, with major expense of living adjustments and links to relevant SHRM material. During open registration, highlight the contribution cap and encourage employees to think about a greater cost savings rate, retirement advisors recommend. Workers in 2021 can again put up to $ 2,750 into their healthcare versatile costs accounts (FSAs) pretax, the Internal Revenue Service revealed. Benefit limits for adoption assistance, transit advantages, and certified small company HRAs were also launched. When we refer to off-exchange strategies, we're just discussing major medical protection the strategies to which ACA regulations apply. A myriad of "excepted advantage" plans (such as short-term medical insurance) are also sold outside the exchanges in the majority of states, and are exempt from ACA policies. But our discussion of off-exchange strategies only describes ACA-compliant strategies offered outside the exchanges.

And the same open registration window November 1 to December 15 in the majority of states uses no matter whether the strategy is sold in the exchange our outside the exchange. But the ACA's premium subsidies and cost-sharing decreases are just offered if you purchase a plan in the exchange. If you buy the precise very same strategy directly from the insurer (ie, off-exchange), you'll need to pay full https://www.ripoffreport.com/report/s/wesley-financial-group-llc-trusted-business-ripoff-report-verified-896644 price, there will be no cost-sharing decreases offered, and you won't have an option to claim the premium tax credit when you file your income tax return the list below year.

If you're curious about off-exchange health insurance, this FAQ provides a more in-depth look at how they're controlled and the reasons some people select off-exchange plans. If your present medical insurance policy is not grandfathered however was in effect prior to 2014, your plan is thought about a transitional health strategy or "grandmothered policy." These plans are not totally ACA-compliant, and were purchased in between March 23, 2010 when the ACA was signed into law and completion of 2013.

Our How Much Does Flood Insurance Cost Diaries

Transitional health strategies were at first slated to end in 2014. However extensions have actually been approved by the federal government every year, allowing these plans to stay in force if the state agrees and if the insurer still wishes to restore the plans. The newest extension allows transitional health strategies to restore up until October 1, 2021, and stay in force until the end of 2021.

( In the staying states, these plans were either required to terminate or insurance providers voluntarily terminated them and replaced them with ACA-compliant coverage.) If you're registered in a transitional strategy and your insurance provider is providing renewal for 2021, you have the alternative to keep your prepare for another year. However it's definitely in your benefit to thoroughly compare your plan with the new choices that are offered in the ACA-compliant market for 2021.

( Premium aids for 2021 are available for a bachelor with an income approximately $51,040. In 2014, a single individual might only get approved for aids with an earnings of as much as $45,960; as the poverty line increases each year, so does the earnings cap for subsidy eligibility.) And the ACA-compliant strategies readily available now are most likely to offer more robust protection including all of the important health advantages than the plan you bought prior to 2014.

She has actually written lots of viewpoints and educational pieces about the Affordable Care Act for healthinsurance. org. Her state health exchange updates are frequently cited by media who cover health reform and by other health insurance coverage experts.

In a lot of states, open enrollment for 2021 coverage will run from November 1 to December 15, 2020, with all strategies efficient January 1, 2021. Open enrollment for 2021 protection ended on December 15, 2020 in a lot of states. California, Colorado, and Washington, DC, have actually completely extended open registration. State-run exchanges have versatility to make OEP longer.

HealthCare. gov, which is the exchange platform that's utilized by the bulk of the states, tends to follow this schedule relatively carefully, while the states that run their own exchange platforms usually use a little longer enrollment windows. how long can you stay on your parents insurance. Health care. gov is being utilized in 36 states for registration in 2021 health strategies (it was 38 states since 2020, however Pennsylvania and New Jersey have both transitioned to their own enrollment platforms as of the fall of 2020; both have actually likewise chosen to extend their open enrollment windows).

Little Known Questions About What Is E&o Insurance.

And the majority of the other fully state-run exchanges have actually chosen to extend the open enrollment duration for 2021 coverage, implying it will continue past December 15. Outside of open enrollment, strategy changes and new registrations are only possible for individuals who experience a certifying occasion. Native Americans and Alaska Natives can register year-round in plans provided in the exchange.

In the following states, open enrollment ended on December 15 (although due to high call volume on December 15, Health care. gov had some callers leave their contact details; the exchange will call these people back over the next couple of days to finish their enrollment in https://www.glassdoor.com/Overview/Working-at-Wesley-Financial-Group-EI_IE1950034.11,33.htm 2021 coverage): California enacted legislation in 2017 and again in 2019 that permanently establishes different enrollment dates within the state, both on and off-exchange.

California's enrollment schedule has differed in previous years, however this three-month window, from the start of November through the end of January, will be the irreversible enrollment window moving forward. Colorado's Division of Insurance coverage has actually also permanently extended open registration. The state settled policies in late 2018 that call for an annual special registration duration, running from December 16 to January 15, that is included to the end of open enrollment each year.

Some Known Factual Statements About How Do I Get Health Insurance

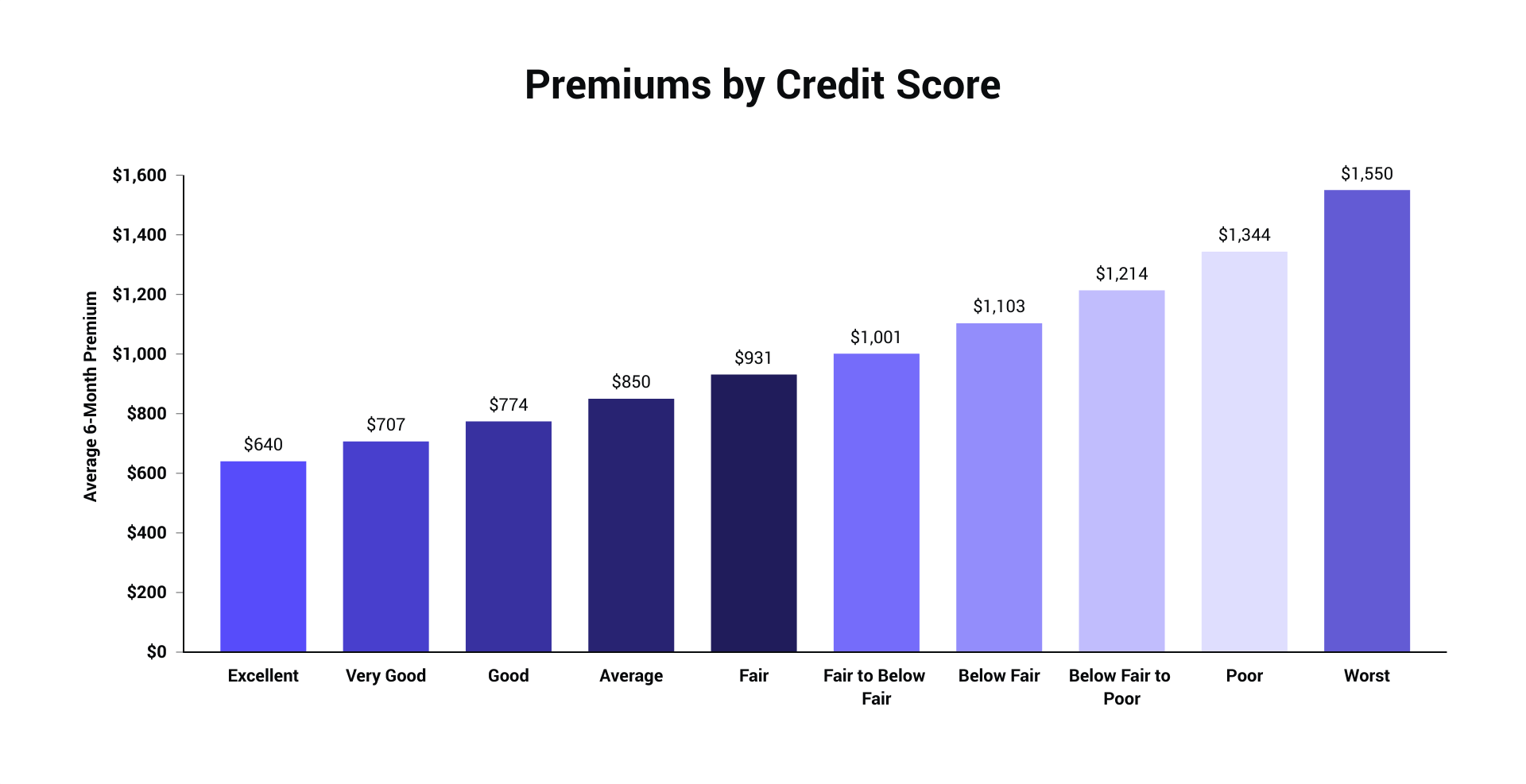

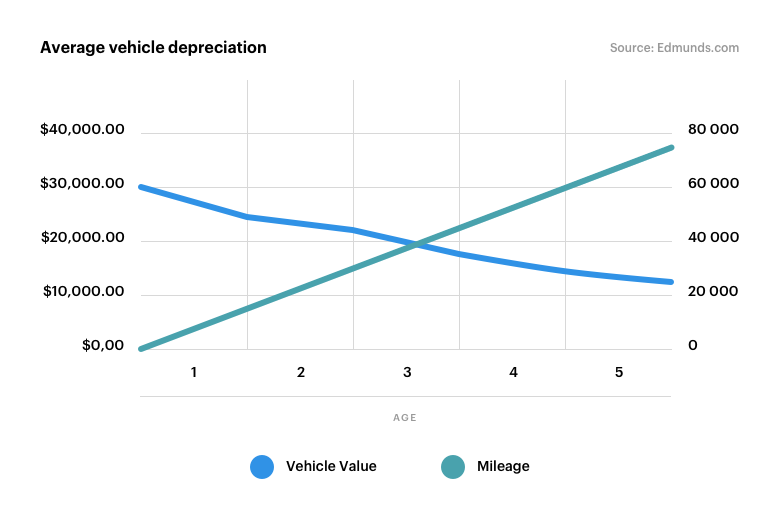

Highway Insurance makes it simple to submit an SR-22 and get high-risk auto insurance that doesn't cost a fortune. Liability insurance coverage pays for residential or commercial property damage you trigger to others while driving. If your cars and truck is harmed from an occurrence that runs out your control, such as theft, fire, vandalism, hitting an animal, acts of nature, or glass damage, comprehensive protection pays to repair or replace your cars and truck. Progressive Many insurance providers charge additional to cover teen and senior citizen chauffeurs. Members of these age groups are most likely to be hurt in automobile mishaps, so carriers see them as more of a danger to insure than other chauffeurs. As an outcome, teenagers and elderly people may require to look a little more difficult in order to discover the most affordable automobile insurance provider that fits their needs at a sensible price.

In addition to being entirely transparent about the differences in between securing a new policy for a teen and including one to an existing policy, the business provides many discounts to younger motorists. There's a discount rate simply for having a motorist 18 or more youthful on your account, along with one for adding another automobile to it.

Those Snapshot savings also benefit drivers aged 75 and above, whom Progressive acknowledges are more expensive to guarantee. As part of the Picture program, Progressive consumers download the Picture app (or use a plug-in device) that monitors their driving habits. People who drive securely or use their vehicles rarely (as lots of seniors do) are eligible for cost savings to the tune of an average of $145 a year.

In addition to cars and truck insurance coverage, The General provides life insurance coverage policies through parent company American Household Insurance coverage. The General acknowledges that not every chauffeur can boast the cleanest record, and that errors-- such as mishaps and driving infractions-- take place behind the wheel. Still, the business ventures to provide affordable rates to motorists who may fall under the "nonstandard" label.

The General extends fringe benefits to all customers. For circumstances, the business offers a "low deposit" option for its strategies, in addition to discounts based upon your automobile's safety devices, your own driving record, and more. Whether you have a less-than-stellar driving history or not, The General is worth an appearance when getting car insurance coverage quotes.

and will certainly be available in handy for chauffeurs trying to find the most affordable vehicle insurance coverage who have lower credit rating. Root utilizes telematics (through an iPhone or Android app) to monitor your driving, and after that Hop over to this website gives you an affordable auto insurance rate based upon how securely you drive. Your credit history never ever enters play-- instead, your driving ability is examined and you conserve money based upon Root's measurements.

Facts About How Much Homeowners Insurance Do I Need Uncovered

Root is able to supply such http://titusvhvb970.raidersfanteamshop.com/the-how-much-does-health-insurance-cost-per-month-pdfs low rates due to the fact that it only guarantees safe motorists. Prospective consumers whose telematics aren't up to standard throughout the test drive duration will not be offered protection. Root is currently offered in 36 states and coming soon in 2 more, so you may wish to examine its website and see if you're eligible for coverage.

" Geico uses a few of the least expensive premiums around for complete protection, and you can even stack discounts for safe driving or several policies to snag extra savings," says Sarah George, vehicle insurance coverage specialist at Finder. com. "If you're trying to find the cheapest rates, Geico will likely provide low premiums for many chauffeurs." It's crucial to compare automobile insurance coverage quotes, as George includes, "Liberty Mutual also contends with valuable choices like brand-new car replacement or a decreasing deductible fund, plus you can select individual service with a regional agent." Your age eventually plays a role in what you're charged for insurance plan protection.

" Progressive is also understood for its wide coverage and online tools that assist you purchase within your spending plan." Not only is Progressive a recommended insurance service provider for younger chauffeurs, but it's a top most affordable insurance provider choice for elderly people as well. Check over here For young drivers and seniors, Progressive deserves thinking about for a cars and truck insurance coverage quote.

A single $2,000 claim can raise your vehicle insurance rates by 41%, according to CBS News. Many major companies will insure nonstandard drivers (again, at a higher vehicle insurance rate), however there are likewise automobile insurer specifically devoted to it. what is deductible in health insurance. "Specific vehicle insurer specialize in higher-risk motorists," states Joel Ohman, certified financial planner and creator of CarInsuranceComparison.

" It ends up being even more crucial [for higher-risk motorists] to go shopping around and compare rates from various car insurance coverage business." Of these nonstandard automobile insurer, one of the most popular is The General. Root Insurance Business figures out automobile insurance coverage premiums on driving practices. Root Insurance coverage Company Some car insurer classify chauffeurs with low credit report as nonstandard.

Root cars and truck insurance, for example, bases your car insurance premium completely on your driving practices, using telematic information. Finding an auto insurer that can conserve you money is very important, however there are things you can do on your own to ensure you conserve money on car insurance coverage. You may be able to get an offer by bundling vehicle insurance coverage with another kind of protection (such as house owners insurance).

The Best Strategy To Use For How Much Does A Tooth Implant Cost With Insurance

In the long term, safe driving can also reduce your premiums. Consider bundling home and car insurance protection with one business for lower premiums. Root Insurance Provider It is likewise possible-- though not necessarily suggested-- to save cash by leaving out specific protections. "You ought to know, skipping protection can put you at danger," states Ross Martin, a certified insurance agent with The Zebra.

While nearly every state requires liability insurance, other coverages are not constantly needed. Depending upon the state in which you live, you might not be needed to bring uninsured or underinsured motorist coverage, personal injury security or [coverage for] medical payments to others."" The kinds of coverage you can avoid depend a lot on your specific scenario," states George.

Written by Scott Fried for Roadshow. Climb up in the motorist's seat for the newest cars and truck news and reviews, provided to your inbox twice weekly.

Some Of How Much Does Home Insurance Cost

Highway Insurance coverage makes it simple to submit an SR-22 and get high-risk car insurance coverage that doesn't cost a fortune. Liability insurance pays for property damage you cause to others while driving. If your car is harmed from an occurrence that is out of your control, such as theft, fire, vandalism, hitting an animal, acts of nature, or glass damage, thorough protection pays to fix or replace your cars and truck. Progressive A lot of insurers charge extra to cover teen and senior person motorists. Members of these age are most likely to be hurt in auto mishaps, so providers see them as more of a threat to guarantee than other motorists. As a result, teens and seniors may require to look a little more difficult in order to find the most affordable cars and truck insurance company that matches their needs at a sensible rate.

In addition to being completely transparent about the distinctions between getting a brand-new policy for a teenager and including one to an existing policy, the company offers many discount rates to younger motorists. There's a discount rate simply for having a chauffeur 18 or younger on your account, along with one for including another vehicle to it.

Those Picture cost savings likewise benefit motorists aged 75 and above, whom Progressive acknowledges are more pricey to guarantee. As part of the Snapshot program, Progressive clients download the Snapshot app (or utilize a plug-in device) that monitors their driving habits. Individuals who drive safely or utilize their cars infrequently (as many seniors do) are eligible for savings to the tune of an average of $145 a year.

In addition to vehicle insurance coverage, The General offers life insurance policies through parent business American Household Insurance coverage. The General acknowledges that not every driver can boast the cleanest record, which mistakes-- such as accidents and driving infractions-- happen behind the wheel. Still, the business ventures to provide sensible rates to drivers who might fall under the "nonstandard" label.

The General extends fringe benefits to all clients. For circumstances, the company offers a "low deposit" option for its plans, in addition to discount rates based upon your car's security devices, your own Hop over to this website driving http://titusvhvb970.raidersfanteamshop.com/the-how-much-does-health-insurance-cost-per-month-pdfs record, and more. Whether you have a less-than-stellar driving history or not, The General is worth a look when getting automobile insurance quotes.

and will definitely come in useful for chauffeurs trying to find the cheapest car insurance coverage who have lower credit history. Root uses telematics (via an iPhone or Android app) to monitor your driving, and then offers you a reduced vehicle insurance coverage rate based upon how securely you drive. Your credit history never ever enters into play-- instead, your driving capability is assessed and you save cash based upon Root's measurements.

The 15-Second Trick For How Much Term Life Insurance Do I Need

Root is able to supply such low rates due to the fact that it only insures safe chauffeurs. Potential clients whose telematics aren't up to requirement throughout the test drive duration will not be offered coverage. Root is currently readily available in 36 states and coming soon in 2 more, so you may desire to check its website and see if you're eligible for protection.

" Geico uses a few of the cheapest premiums around for complete coverage, and you can even stack discounts for safe driving or several policies to snag additional savings," says Sarah George, vehicle insurance coverage expert at Finder. com. "If you're trying to find the least expensive rates, Geico will likely offer low premiums for many motorists." It's crucial to compare vehicle insurance quotes, as George adds, "Liberty Mutual also contends with practical options fresh cars and truck replacement or a diminishing deductible fund, plus you can decide for personal service with a local representative." Your age ultimately plays a role in what you're charged for insurance coverage protection.

" Progressive is likewise understood for its wide protection and online tools that help you purchase within your budget." Not just is Progressive a suggested insurance coverage service provider for younger motorists, however it's a top most affordable insurer choice for senior citizens also. For young motorists and seniors, Progressive is worth considering for a car insurance quote.

A single $2,000 claim can raise your auto insurance rates by 41%, according to CBS News. A lot of significant business will guarantee nonstandard chauffeurs (again, at a greater vehicle insurance rate), but there are also cars and truck insurance provider particularly committed to it. what is a premium in insurance. "Specific car insurance coverage companies specialize in higher-risk chauffeurs," says Joel Ohman, certified financial planner and creator of CarInsuranceComparison.

" It becomes even more crucial [for higher-risk motorists] to search and compare rates from various vehicle insurance coverage companies." Of these nonstandard vehicle insurance provider, one of the most popular is The General. Root Insurance provider figures out car insurance coverage premiums on driving habits. Root Insurance Business Some vehicle insurance provider classify chauffeurs with low credit rating as nonstandard.

Root car insurance, for example, bases your cars and truck insurance premium totally on your driving habits, utilizing telematic information. Finding a car insurer that can conserve you money is essential, however there are things you can do on your own to ensure you conserve money on car insurance coverage. You may be able to get a deal by bundling car insurance with another kind of protection (such as house owners insurance).

The Ultimate Guide To What Is Policy Number On Insurance Card

In the long term, safe driving can also reduce your premiums. Think about bundling home and automobile insurance protection with one business for lower premiums. Root Insurance Business It is also possible-- though not necessarily recommended-- to conserve cash by leaving out certain coverages. "You must know, avoiding coverage can put you at threat," says Ross Martin, a licensed insurance coverage representative with The Zebra.

While almost every state needs liability insurance coverage, other coverages are not always needed. Depending upon the state in which you live, you may not be required to carry uninsured or underinsured driver protection, accident defense or [coverage for] medical payments to others."" The types of protection you can avoid depend a lot on your particular scenario," says George.

Written by Scott Fried for Check over here Roadshow. Climb up in the motorist's seat for the most recent cars and truck news and evaluations, delivered to your inbox twice weekly.

Our What Does An Insurance Underwriter Do Ideas

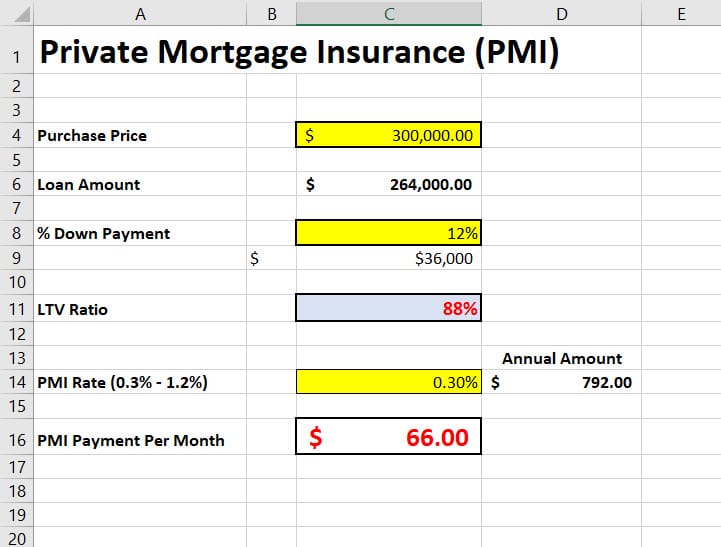

This equity would assist pay the loan balance in the event you default and go into foreclosure (how do insurance companies make money). Your lending institution requires you to have personal home mortgage insurance so that if you can no longer pay on your house, the lender will still get paid (through the personal insurance coverage). PMI basically safeguards the lender in case of borrower default.

If you fall behind on your payments, your credit rating could suffer or you could lose your house through foreclosure. You are usually required to pay a personal home mortgage insurance premium on a standard loan for as numerous months or years it requires to develop adequate equity in your home to equal 20 percent of your home's value and have a loan-to-value ratio of 80 percent.

Once again, MIP for an FHA loan is different than PMI on a traditional loan. Contact your lending institution if you have concerns about the home loan insurance coverage premium on your FHA loan. Normally, if you put down 20 percent or more when you purchase a house, you can generally avoid spending for personal home loan insurance coverage on a standard loan (not an FHA loan).

It's an adhering loan for low- and moderate-income home buyers that enables a deposit of 3% and does not need mortgage insurance. Certified veterans can apply for a VA loan that permits up to one hundred percent financing (that's a $0 down payment) and does not require home mortgage insurance coverage. They might only require an upfront financing charge that certain veterans might be exempt from.

Some lenders provide non-conforming and portfolio alternatives that accept deposits just 10-15% and do not require PMI. Doctor loans typically do not need PMI if the down payment is less than 20%. Another option to avoid paying PMI, referred to as "piggybacking," is taking out a smaller loan for sufficient money to cover the 20% deposit so that you can avoid paying private home mortgage insurance coverage.

But you can usually deduct the interest on our federal tax return. You will also need to consider whether you can afford to pay a second loan for a set number of years in addition to your home mortgage payment. Contact your tax adviser or monetary coordinator for more information. If you are paying PMI on a conventional loan, you can ask for to cancel it (see listed below) once you have actually built up enough equity in your house.

A Biased View of What Happens If I Don't Have Health Insurance

You'll likewise http://edwingefa381.yousher.com/the-25-second-trick-for-how-much-does-insurance-go-up-after-an-accident want to make certain your credit rating is high enough to qualify, and that interest rates make monetary sense for you. Contact your lender if you have questions about the home mortgage insurance on your FHA loan (how do i get health insurance). When the customer has constructed up a certain amount of equity in your house, typically 20% equity, private home mortgage insurance normally may be canceled which will decrease your home mortgage payment and enable you pay less money every month.

So if you own a home with a value of $100,000 and have actually paid down $20,000 in principal, you can ask for to cancel your PMI. Make sure to contact your lending institution as soon as you have actually hit 20 percent equity.

Editorial Note: Forbes might make a commission on sales made from partner links on this page, but that doesn't impact our editors' opinions or evaluations. If you're buying a house for the very first time, you might be considering an FHA home loan. These loans make it simpler to get into a house thanks to less strict credit and down payment requirements.

Here's what you need to learn about FHA home mortgage insurance before getting a loan. If you secure a home mortgage and make a down payment of less than 20% or re-finance an existing home loan with less than 20% equity, you're usually needed to pay personal home loan insurance coverage (PMI).

When a conventional home loan loan provider needs you to pay PMI, it develops an insurance policy through its network of providers and after that works out the information with you at closing. You can select to pay your yearly insurance coverage premium up front, or have it rolled into your home mortgage loan and paid in installments along with your home mortgage payments.

Let's take a more detailed look at the details of FHA home loan insurance coverage below. An FHA loan is a certain type of mortgage that's backed by the Federal Real Estate Administration. It's developed to help prospective property owners who wouldn't otherwise certify for a budget friendly conventional loan, especially novice homebuyers. FHA loans are readily available to customers with credit rating of a minimum of 500.

About When Is Open Enrollment For Insurance

5% down with a credit report of a minimum of 580, otherwise a down payment of a minimum of 10% is required. Unlike private home mortgage insurance, FHA home loan insurance coverage is needed on all FHA loans regardless of the down payment amountand can't be cancelled in the majority of cases. Presently, if you put down less than 10% on an FHA loan, you're required to pay home mortgage insurance coverage for the whole length of the loan.

There are two components to FHA mortgage insurance. First, there's an in advance mortgage insurance premium of 1. 75% of the overall loan quantity. So if you obtained $150,000, you 'd be needed to pay an in advance cost of $2,625. You're likewise needed to pay an annual home loan insurance premium of 0.

05% of the loan amount, depending upon a few aspects. Like PMI, you have the choice of paying your annual premium up front or rolling the expense into your loan. Keep in mind that it can be easier to roll your premiums into your loan, however that will cost you more in the long run due to the fact that you'll also be paying interest on it over the course of the year.

That said, you do not need to be stuck paying FHA mortgage insurance coverage for the entire length of your loan. Customers often choose FHA mortgage since they're simpler to qualify for than conventional home mortgages. You can certify with a credit report as low as 500, and put as little as 3.

The tradeoff is paying the extra expense of home mortgage insurance. Nevertheless, after a couple of years of diligently paying down your FHA home loan, your credit might be in much better shape and you probably will have developed some equity in your house. If that's the case, you might consider re-financing to a non-FHA home loan.

Obviously, it's constantly an excellent idea to crunch the numbers and see which option makes the most financial sense. Like anything associated to homebuying, it's a great idea to invest some time assessing the benefits and drawbacks of taking out an FHA loan that features mortgage insurance coverage. Here's a better look at some of the factors you may get more info consider paying FHA mortgage insuranceas well as reasons to avoid it.

The Of What Is A Deductible Health Insurance

If you plan to secure a home loan without a full 20% down payment, paying Additional resources private mortgage insurance on a conventional loan can be pricey if your credit isn't fantastic. That's due to the fact that the cost of PMI premiums goes up as your credit history decreases. FHA home loan insurance coverage, on the other hand, doesn't take your credit into factor to consider when rates.

Indicators on What Is E&o Insurance You Need To Know

A term life insurance policy generally is more economical, since it insures you for a set duration, such as ten years. At the end of the term, you should purchase a new policy. Cash-value insurance covers you for your whole life, as long as you pay your premiums. It slowly constructs a worth on a tax-deferred basis.

Maturity typically happens when the insured reaches age 100, states Foley.A cash-value policy can be obtained versus for such expenses as deposits on homes and college tuition. The money worth is different, though, than the policy's face amount which is the cash that will be paid upon your death, or when the policy matures.

It may sound like a great concept to purchase more life insurance coverage than you need, but taking on too much protection will place an unnecessary strain on your bank account. MarketWatch mention that it's an excellent concept to have enough coverage to settle your mortgage. After that, the quantity you pick should be based upon the needs of your dependents.

Some Known Incorrect Statements About How Much Does An Insurance Agent Make Per Policy

If you're widowed and your kids are grown, your need for life insurance coverage is most likely to be Visit website much less than a primary income producer with a partner and young kids, states Jim Armitage, an insurance coverage agent in Arcadia, Calif. "Everything depends on what your goals are and what your requirements are," he says.

The larger the policy you buy, the more cash they make. In some cases representatives will advise clients to replace existing policies simply to produce new sales, states Foley." Beware if your agent offers you a policy and informs you a number of years later they have a much better offer," he states.

Do not be afraid to ask about your representative's commission on different insurance products. If you're searching for a way to invest your money, there normally are more profitable methods to do so than purchasing a life insurance policy. While permanent life insurance has an investment component, the main purpose of any life policy is to replace the earnings of the insured and to safeguard his or her dependents.

How more info To Become A Shelter Insurance Agent - Truths

" It is a tool for providing a cash flow to your family after death - how to be a good insurance agent." There are cases, however, when it makes good sense for high net-worth people to minimize estate taxes by purchasing permanent life policies. Consult a qualified wealth organizer to explore your choices.

A life insurance agent's commission depends on a couple of aspects, including the company's commission plan and just how much life insurance coverage the representative is selling. Here is all the info you require to understand to help you learn how much the individual selling you your life insurance policy is making, and a few pointers to help you comprehend what the choices are when it concerns selecting who to buy your life insurance from.

Life insurance coverage policy sales generally give the certified agent compensation from a commission and often wage if they are contracted staff members. Lots of people who sell life insurance coverage work on agreement so commission may be their main source of earnings. We enter into the details and exact numbers below. The size of their customer base How lots of companies they work with (slave only handling one insurance carrier versus non-captive) Their years of experienceWhether they are licensed to sell in different categories (Personal Financial Consultant, Life Insurance Agent, Broker) What their settlement agreement is with the insurance companyWhat their compensation contract is with the company, or if they are independentIf they have expenses to pay from the commission such as lease, staff, and materials Other factors might impact just how much cash they scamper your policy, however this offers you an idea of the reasons someone might make more or less than another.

The Buzz on How Much Does An Insurance Agent Make

Life insurance companies understand this, so when a sale is made the commission might be perceived as high due to the fact that the model requires to account for this. Your life insurance premium itself does not alter based upon commission. The commission is the part of the premium the insurance company offers the representative for having made the sale, and after that for providing great customer support to keep the customer through a number of years.

Other models of settlement may consist of greater incomes, and less commission portion since of the plan they have actually made http://franciscogqgj363.trexgame.net/how-much-does-a-doctor-visit-cost-without-insurance-things-to-know-before-you-get-this in their employment agreement. If they are independent, they might even make all of the commission from the sale, nevertheless, if they work for a company, they might have an arrangement that makes it so that they are not receiving the entire commission due to the reality they have actually concurred to a salary instead.

However, with the right info and concerns, you can discover. When you attempt and discover the typical income of a life insurance coverage agent, due to the fact that of the aspects above, it is extremely difficult to say. According to the Bureau of Labor Data, the mean pay for an "insurance sales agent" is $50,560 per year or $24.

The Best Guide To What Does A Life Insurance Agent Do

Remember that this specifies a sales agent, and consists of information from all insurance, not just life insurance. Because of the designs explained above (" commission heavy" or "salary heavy") this number varies greatly, and because it is an average, it is not revealing you the luxury of the more established representatives, or those who sell greater valued policies.

73 per hour. There are various sort of life insurance coverage policies. The type of life insurance policy will also impact the quantity of cash that will be paid in commission. The bigger longer term policies will normally pay more on commission. The two main types of policy are term life and entire life or cash-value policies, likewise referred to as universal life policies.

Term insurance coverage lasts for a minimal "term" or time period, such as 5,10, 20 or 30 years. Whole life insurance lasts your whole life and it may develop money worth gradually. and offer the possibility of borrowing cash from your life insurance coverage policy. Your representative's commissions can differ depending on the kind of life insurance coverage you pick.

The How To Become A Certified Insurance Agent PDFs

Top ranking manufacturers might even get 100% of the complete premium in the first year as commission and often 2% to 5% commission from the second to the 4th year. Subsequent year commissions might drop off or can be much lower. The quantity of commission paid will vary based upon the arrangement the representative has with the insurance coverage company or with their company (if they are not contracted employees).

In all designs, the payment structure for compensation adjusts for the scenario, so you ought to not be paying more for life insurance coverage if you go through a broker vs. an agent or direct through a provider. The commissions they get are frequently adjusted for the circumstance and arrangements they have actually signed.

Brokers can often get you quotes with a number of companies to provide you an opportunity to compare alternatives. When you go through the provider straight, they will just be using you their products. If you are stressed over added charges, ask the individual quoting you if there are any additional service charge and look around for your options.

Getting My How Much Home Insurance Do I Need To Work

This equity would help pay the loan balance in case you default and go into foreclosure (how much does a tooth implant cost with insurance). Your lending institution needs you to have personal mortgage insurance so that if you Additional resources can no longer pay on your house, the get more info loan provider will still earn money (through the private insurance coverage). PMI generally safeguards the lending institution in the occasion of debtor default.

If you fall behind on your payments, your credit score could suffer or you might lose your home through foreclosure. You are generally needed to pay a personal home mortgage insurance coverage premium on a traditional loan for as numerous months or years it requires to build adequate equity in your home to equivalent 20 percent of your home's worth and have a loan-to-value ratio of 80 percent.

Again, MIP for an FHA loan is various than PMI on a conventional loan. Contact your lender if you have questions about the home mortgage insurance coverage premium on your FHA loan. Generally, if you put down 20 percent or more when you buy a home, you can typically avoid spending for private home mortgage insurance coverage on a standard loan (not an FHA loan).

It's an adhering loan for low- and moderate-income home buyers that enables a down payment of 3% and does not need home mortgage insurance. Qualified veterans can get a VA loan that permits approximately one hundred percent financing (that's a $0 deposit) and does not need mortgage insurance. They may only need an upfront financing charge that specific veterans may be exempt from.

Some lending institutions offer non-conforming and portfolio alternatives that accept down payments just 10-15% and do not require PMI. Physician loans typically do not require PMI if the deposit is less than 20%. Another option to avoid paying PMI, described as "piggybacking," is taking out a smaller sized loan for enough cash to cover the 20% deposit so that you can prevent paying private home loan insurance coverage.

But you can usually subtract the interest on our federal tax return. You will likewise need to think about whether you can pay for to pay a second loan for a set number of years in addition to your home loan payment. Contact your tax adviser or financial coordinator for more info. If you are paying PMI on a conventional loan, you can ask for to cancel it (see listed below) once you have actually constructed up enough equity in your house.

The Ultimate Guide To What Does Renters Insurance Not Cover

You'll likewise desire to make sure your credit rating is high enough to qualify, and that rates of interest make monetary sense for you. Contact your loan provider if you have questions about the home mortgage insurance coverage on your FHA loan (what is a health insurance premium). Once the customer has constructed up a particular amount of equity in your house, generally 20% equity, personal mortgage insurance normally may be canceled which will lower your home loan payment and enable you pay less money every month.

So if you own a house with a value of $100,000 and have actually paid for $20,000 in principal, you can request to cancel your PMI. Be sure to call your lender as soon as you have actually struck 20 percent equity.

Editorial Note: Forbes might earn a commission on sales made from partner links on this page, but that does not impact our editors' viewpoints or evaluations. If you're buying a home for the first time, you might be considering an FHA home loan. These loans make it easier to enter a house thanks to less stringent credit and deposit requirements.

Here's what you need to understand about FHA home mortgage insurance coverage prior to requesting a loan. If you get a home loan and make a down payment of less than 20% or re-finance an existing mortgage with less than 20% equity, you're usually required to pay private mortgage insurance coverage (PMI).

When a standard mortgage loan provider needs you to pay PMI, it develops an insurance policy through its network of providers and then works out the details with you at closing. You http://edwingefa381.yousher.com/the-25-second-trick-for-how-much-does-insurance-go-up-after-an-accident can choose to pay your yearly insurance premium in advance, or have it rolled into your mortgage loan and paid in installments together with your home mortgage payments.

Let's take a more detailed take a look at the information of FHA home mortgage insurance listed below. An FHA loan is a specific type of home loan that's backed by the Federal Real Estate Administration. It's designed to assist potential house owners who would not otherwise qualify for a cost effective standard loan, especially novice property buyers. FHA loans are readily available to customers with credit history of a minimum of 500.

10 Simple Techniques For What Is Short Term Health Insurance

5% down with a credit report of a minimum of 580, otherwise a down payment of at least 10% is required. Unlike private mortgage insurance, FHA home loan insurance is required on all FHA loans regardless of the down payment amountand can't be cancelled in many cases. Currently, if you put down less than 10% on an FHA loan, you're required to pay home loan insurance for the entire length of the loan.

There are 2 elements to FHA home mortgage insurance. Initially, there's an upfront mortgage insurance coverage premium of 1. 75% of the overall loan quantity. So if you borrowed $150,000, you 'd be required to pay an upfront fee of $2,625. You're also required to pay a yearly home mortgage insurance coverage premium of 0.

05% of the loan amount, depending on a couple of aspects. Like PMI, you have the choice of paying your annual premium up front or rolling the expense into your loan. Remember that it can be easier to roll your premiums into your loan, however that will cost you more in the long run because you'll likewise be paying interest on it over the course of the year.

That said, you do not have actually to be stuck paying FHA mortgage insurance for the entire length of your loan. Customers typically opt for FHA home loan because they're easier to get approved for than standard home loans. You can certify with a credit history as low as 500, and put as little as 3.

The tradeoff is paying the additional expense of mortgage insurance. However, after a few years of vigilantly paying for your FHA home mortgage, your credit might be in much better shape and you most likely will have developed some equity in your house. If that holds true, you might think about re-financing to a non-FHA mortgage.

Of course, it's always a great concept to crunch the numbers and see which option makes the most monetary sense. Like anything related to homebuying, it's a good idea to spend some time assessing the pros and cons of securing an FHA loan that comes with home mortgage insurance coverage. Here's a more detailed take a look at some of the factors you may think about paying FHA mortgage insuranceas well as factors to avoid it.

Not known Details About What Is The Best Dental Insurance

If you plan to secure a home loan without a complete 20% deposit, paying private home mortgage insurance coverage on a conventional loan can be costly if your credit isn't terrific. That's due to the fact that the cost of PMI premiums increases as your credit score decreases. FHA home mortgage insurance coverage, on the other hand, does not take your credit into consideration when pricing.

The Ultimate Guide To How To Get A Breast Pump Through Insurance

This equity would help pay the loan balance in case you default and go into foreclosure (how to get therapy without insurance). Your loan provider needs you to have private mortgage insurance so that if you can no longer make payments on your house, the lending institution will still get paid (through the private insurance policy). PMI generally safeguards the lender in the occasion of customer default.

If you fall back on your payments, your credit history might suffer or you could lose your house through foreclosure. You are normally needed to pay a personal home mortgage insurance premium on a standard loan for as many months or years it requires to develop sufficient equity in your house to equal 20 percent of your home's value and have a loan-to-value ratio of 80 percent.

Again, MIP for an FHA loan is different than PMI on a conventional loan. Contact your loan provider if you have concerns about the mortgage insurance coverage premium on your FHA loan. Usually, if you put down 20 percent or more when you buy a home, you can usually prevent spending for private home loan insurance coverage on a traditional loan (not an FHA loan).

It's a conforming loan for low- and moderate-income house buyers that allows a down payment of 3% and does not need mortgage insurance. Certified veterans can get a VA loan that permits approximately one hundred percent funding (that's a $0 deposit) and does not require home loan insurance. They might only need an in advance funding fee that specific veterans might be exempt from.

Some loan providers use non-conforming and portfolio choices that accept deposits as low as 10-15% and do not need PMI. Physician loans generally do not need PMI if the deposit is less than 20%. Another choice to prevent paying PMI, referred to as "piggybacking," is securing a smaller sized loan for adequate cash to cover the 20% down payment so that you can avoid paying private home mortgage insurance.

However you can usually deduct the interest on our federal tax return. You will also require to consider whether you can pay for to pay a second loan for a set variety of years in addition to your home mortgage payment. Contact your tax advisor or financial planner for more info. If you are paying PMI on a standard loan, you can request to cancel it (see below) once you've developed enough equity in your house.

The Ultimate Guide To How To Get A Breast Pump Through Insurance