How Long Does An Accident Stay On Your Insurance for Dummies

Nevertheless, the regulatory environment is expected to remain steady this year. S&P 500 When S&P 500 is bullish, there is greater dividend from investments for insurance companies. Check out this site The S&P 500 is anticipated to increase this year. State Farm Mutual Auto Insurer Allstate Insurance Coverage Company Liberty Mutual Group Inc. The Travelers Companies Inc.

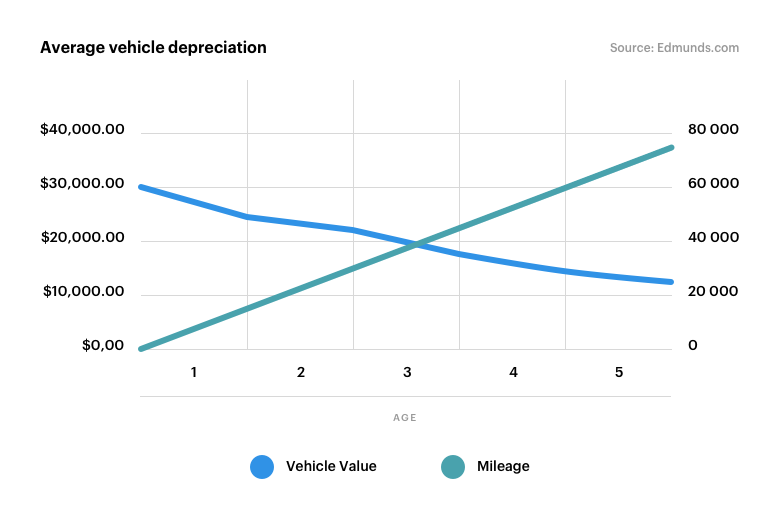

Loss and loss adjustment expenditures At over 60%, Loss and loss adjustment expenditures are by far the biggest cost for industry operators. Incomes Less than 10% of the industry income this year will be accounted for incomes and is anticipated to decline in the next 5 years. Other Purchases make up a small portion of the current industry earnings; while rent, energies, and marketing expenses account for about 3%, and devaluation is 1%.

It is much easier to begin with one kind of insurance coverage (automobile, health, life, animal, and so on), and offer a variety of products within that a person category. This will keep your company less complex and more manageable for you. You can expand your products and plans when you have established your business.

Recognize insurance coverage needs that aren't being satisfied by your competitors. You can not just obtain and offer insurance items and plans without a license. Know the federal government requirements for being a licensed insurance coverage agent and get licensure. Pre-licensing courses are available either online or in a class setting to assist you pass the state test.

This will provide you a clearer price quote of just how much money you will need and help you assess whether you are in need of making an application for organization loans. Search for an office where you can oversee your employees and satisfy potential clients. Having a physical area gives your business reliability, compared with only having a site.

Reach out to individuals you understand, and determine and call potential customers. Prepare a strategy on how you will persuasively present your items and insurance strategies. A memorable and professional discussion will provide you an advantage over your rivals. Increase your online presence and maximize your social media accounts. This is the most reliable and inexpensive tool you can use to market your company.

Not known Incorrect Statements About Which Of The Following Best Describes How Auto Insurance Companies Manage Risk?

Starting an insurance provider will cost you around $5,000 to $50,000 or more. An insurer owner makes $100,000-$ 126,347. For additional information on the travel company market, consider these industry resources: Don't you wish there was a quicker, much easier method to complete your service strategy? With Growthink's Ultimate Insurance coverage Company Plan Design Template you can finish your strategy in simply 8 hours or less! Click http://www.timesharetales.com/meettheceo/ on this link to complete your insurance coverage organization plan today.

Insurance is huge service, however with many laws and guidelines surrounding the industry, how do you break in? In Michigan, if you desire to start an insurer, you need to end up being a certified agent in the type of insurance coverage you wish to offer by completing a series of insurance courses and exams. how do i know if i have gap insurance.

End up being a licensed insurance agent. The Financial and Insurance Coverage Regulation Department of the Michigan Department of Energy, Labor and Economic Development (DELEG) is in charge of representative licensing. To become a licensed representative, you will require to finish state-approved insurance coverage courses and examinations, though the type and number of courses you require to complete depend on the type of insurance coverage you wish to sell.

After finishing the courses, you will then need to submit the appropriate licensing application for your insurance coverage field, which are also available online. Choose how to structure your insurance provider. Starting a true insurance companyone in which you finance all of your policies yourselfrequires a significant amount of start-up capital and is very tough for a single representative to do.

Michigan state insurance law determines the products you can use to your clients, however there might be other regulations you have to abide by too. If you decide to open a franchise, the moms and dad business will require a preliminary financial investment, and you will have to meet the franchise credentials standards.

If you choose to begin an independent insurance organization, you will need to reach suppliers, which may be hesitant to deal with you unless you have a performance history in business, such as a great history as an employee with another insurance provider. Establish your insurance business.

8 Simple Techniques For What Is Gap Insurance And What Does It Cover

You can finish this on the Michigan Organization One Stop site run by the state government. You will then require to make an application for a license to do business as an insurer in Michigan, which you can do online utilizing the National Insurance coverage Producer Registry or by downloading a paper application from the DELEG website.

The Bilton Law Practice, PLLC represents people hurt in Virginia, including Arlington, Alexandria, Fairfax, Falls Church, Tysons Corner, Vienna, and Reston; Maryland, consisting of Bethesda, Rockville, Silver Spring, College Park, Laurel, Bowie, Lanham, Upper Marlboro, and Temple Hills, and anywhere in Washington, DC.The Bilton Law office has three convenient places in the DC City: Main Office: 700 12th Street, NW, Suite 700, Washington, DC 20005Virginia Workplace: 10605 Judicial Drive, Suite A6, Fairfax, VA 22030Maryland Office: 4300 Forbes Boulevard, Suite 205, Lanham, MD 20706This site is lawyer marketing.

Starting an insurance coverage firm can be one of the most rewarding ventures you can carry out and not just from a monetary point of view. Kick back and we'll talk you through all the steps you need to require to launch yourself on this incredible journey. Throughout this guide, you'll discover lots of gems of help, details, and motivation such as: Who should Start an Insurance Coverage Agency? What are your Regular Monthly Operating Costs? Handling Non-Compete & Non-Piracy Agreements.

Choosing your Agency Entity Type. Getting a Firm License. Starting an independent insurance agency isn't easy but can be really gratifying. Once you get moving, you require to keep momentum, consumers are the lifeblood of any service and insurance firms are no various. To that end we supply support in the following areas: Selecting your Company's Name.

Setting Up a Website and Search Engine Optimization. Winning with Social Network Sites. Accessing Online Resources. Getting Provider Visits. The Insurance Coverage Firm Aggregator Advantage. Buying A Company Off the Shelf. How to Acquire Books of Organization. Is Partnering for You? Once you're on the road to success, what's much better than a couple of insider secrets and advanced ideas to keep your nose in front of the competition? Further into this handbook for success in the insurance field, you'll find plenty ideas to put in your toolkit like: Securing your E&O Insurance.

Using Other Technologies. Do Specializations & Niches Make Sense? Establishing your Workplace. Preparation your Firm Staffing. Getting Insurance Education. Bookmark this page, share it on Facebook, or email it to a colleague since it's an important resource that numerous visitors have actually referred back to on countless occasions. Preparation the roadway ahead with our guide This guide is for those who have insurance experience, either as a producer or as a captive representative (direct author firm), and are now seeking to begin an independent company.